Toulouse - 13 June 2023

Global Market Forecast 2023

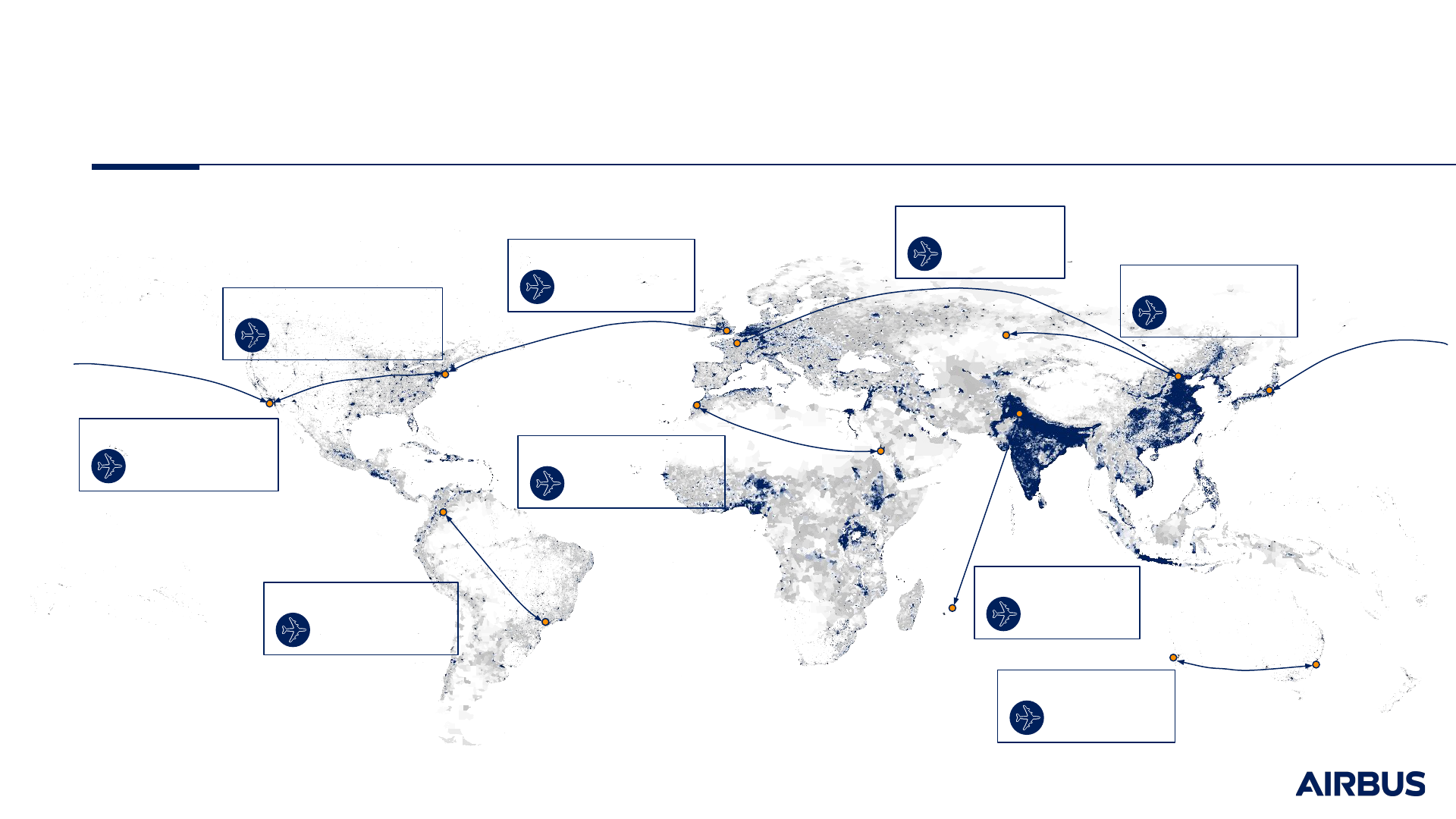

World’s population by density

Source: CIESIN, SEDAC, Airbus GMF

2

Air transport brings the world’s population centres together

Airbus Global Market Forecast 2023

Los Angeles - New York

5 hours

New York - London

7 hours

Tokyo - Los Angeles

10 hours

Bogota - Sao Paulo

6 hours

Casablanca - Jeddah

6 hours

Paris - Beijing

10 hours

Astana - Beijing

5 hours

Perth - Sydney

4 hours

Mauritius - Delhi

8 hours

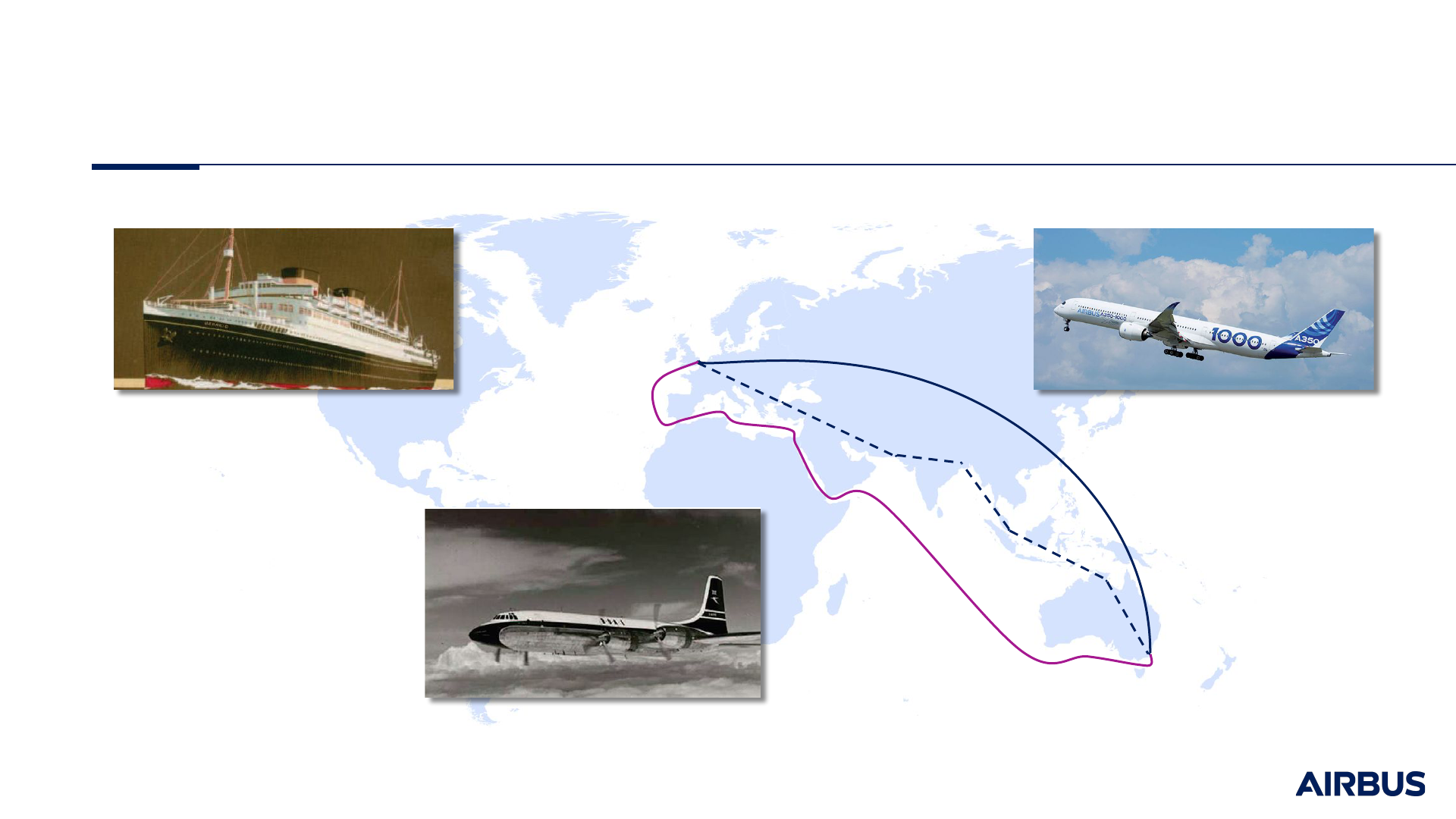

Air transport has given us simpler and faster connections

Source: BOAC Timetable 1957, Airbus GMF

3

London

Istanbul

Karachi

Kolkata

Singapore

Sydney

Darwin

2025

~20 hours

1957

5 days trip

1952

6 weeks trip

Airbus Global Market Forecast 2023

Source: OAG (September data), Airbus GMF

4

Air transport connects more countries than ever, facilitating exchanges

New country pairs that have been created between 1999-2019:

1,020 new worldwide country pairs (+33%)

469 intra-regional (+30%)

551 inter-continental (+36%)

New additional country pairs served by a non stop flight between 1999-2019

Airbus Global Market Forecast 2023

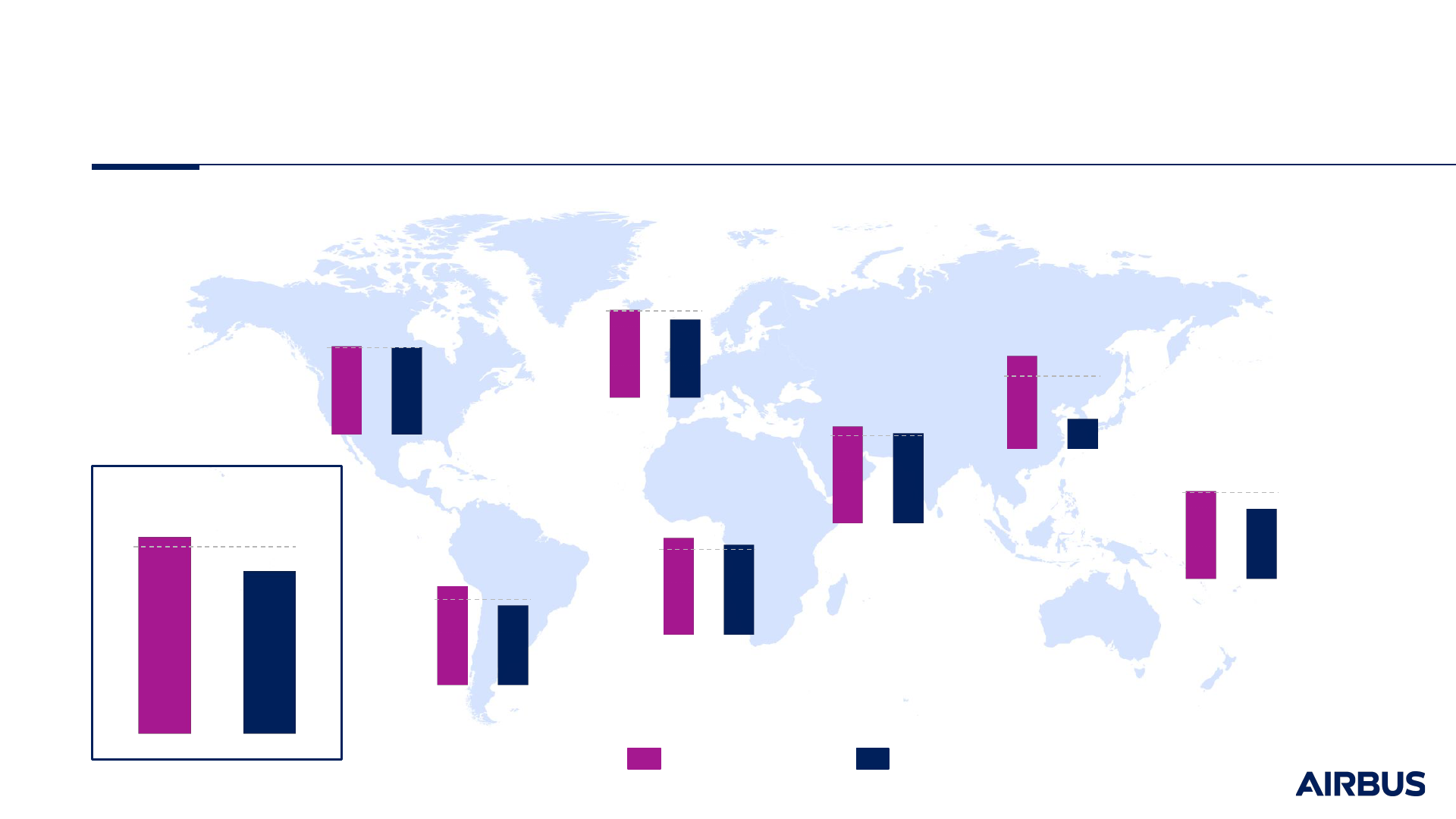

Post-Covid capacity has recovered quickly as restrictions were lifted

5

Airbus Global Market Forecast 2023

Source OAG, Airbus GMF

North America

Latin America

Africa

Europe & CIS

Middle East

PRC

Asia/Pacific

(excl. PRC)

Intl.Dom.

100%

102%

101%

Intl.

Dom.

100%

114%

92%

100%

Intl.Dom.

112%

104%

Intl.Dom.

100%

112%

104%

Intl.Dom.

100%

101%

90%

Intl.Dom.

100%

126%

41%

Intl.Dom.

100%

101%

81%

World

InternationalDomestic

100%

108%

89%

May 2023 (Dom.)

May 2023 (Intl.)

ASKs compared to 2019 level

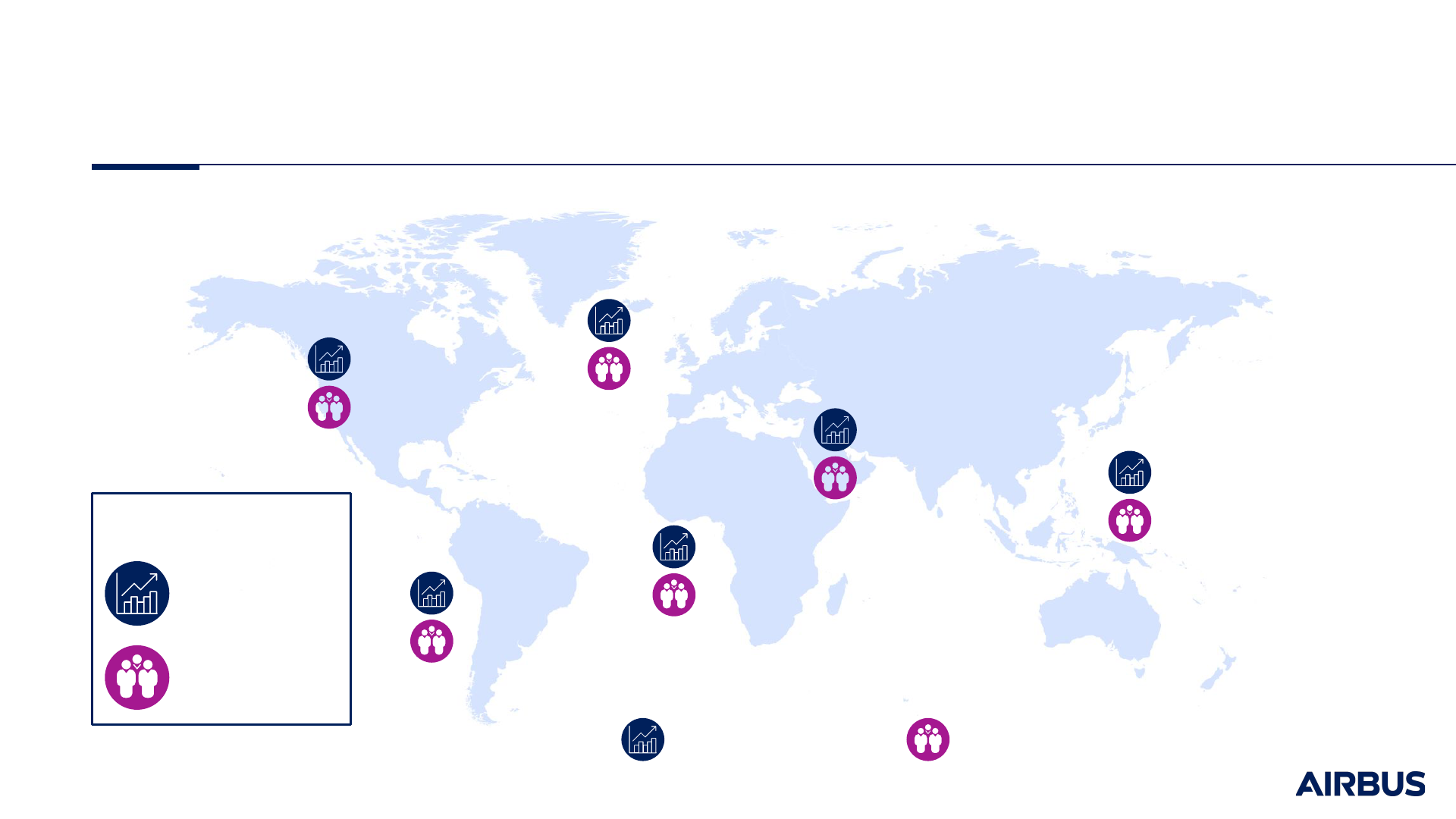

Air transport is a major contributor to GDP and Employment

6

Airbus Global Market Forecast 2023

North America

Latin America

Africa

Europe & CIS

Middle East

Asia/Pacific

Source: ATAG’s Aviation Benefits Beyond Borders, September 2020, Oxford Economics, Airbus GMF

* Employment figures include direct, indirect, induced and tourism catalytic jobs

Contribution of air transport

to regional GDP 2018

Contribution of air transport

to Employment* 2018

World

4.1% GDP

$3.5 trillion

87.7M jobs

3.1%

46.7M

5.0%

8.7M

3.5%

7.7M

4.4%

13.5M

2.7%

7.7M

7.6%

3.4M

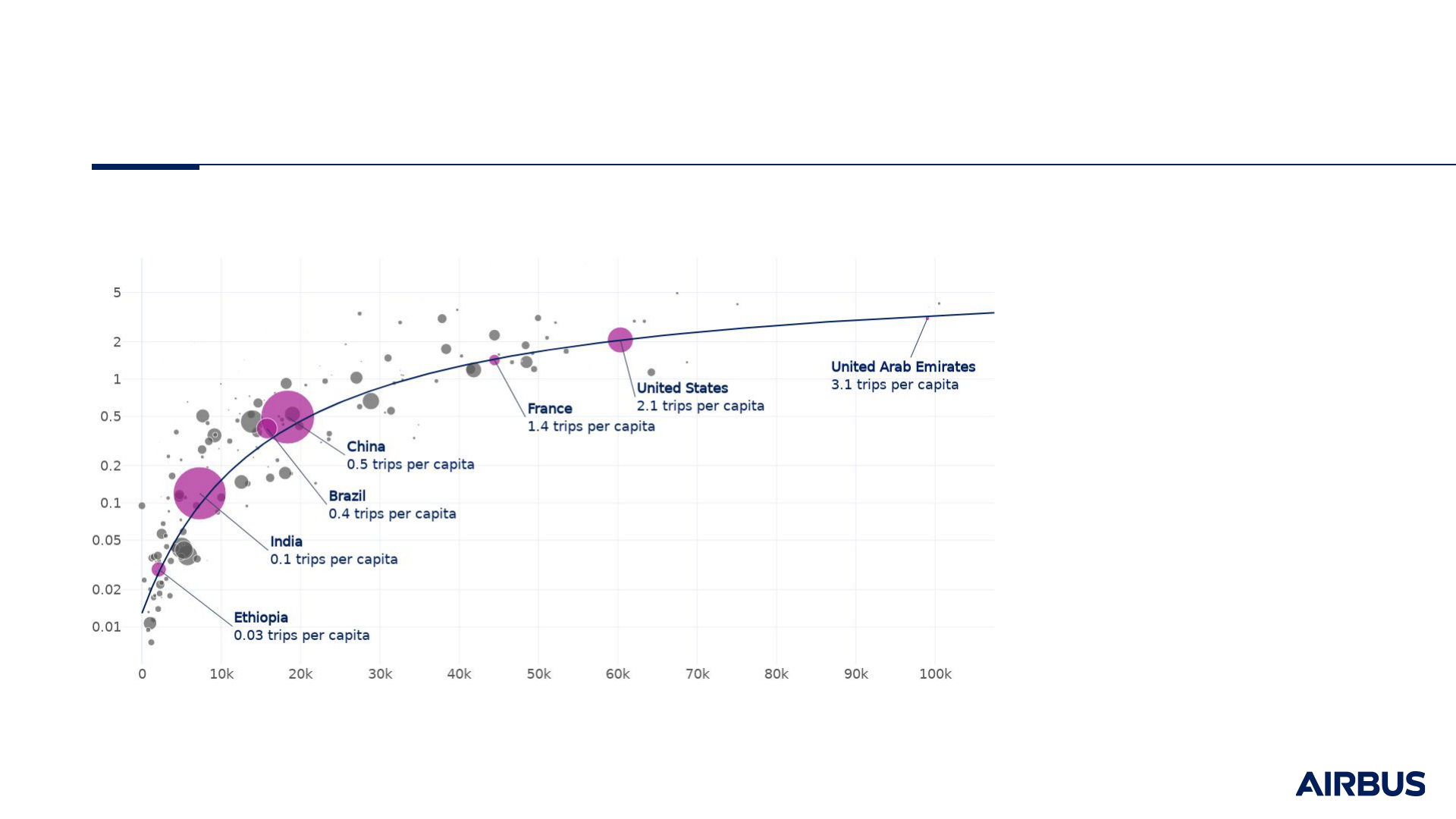

Air transport is tightly linked to economic development and geography

Airbus Global Market Forecast 2023

Source: IHS Markit, Sabre GDD, Airbus GMF

7

2019 yearly trips per capita (bubble size proportional to country population)

GDP per capita (Purchasing Power Parity $ - 2015)

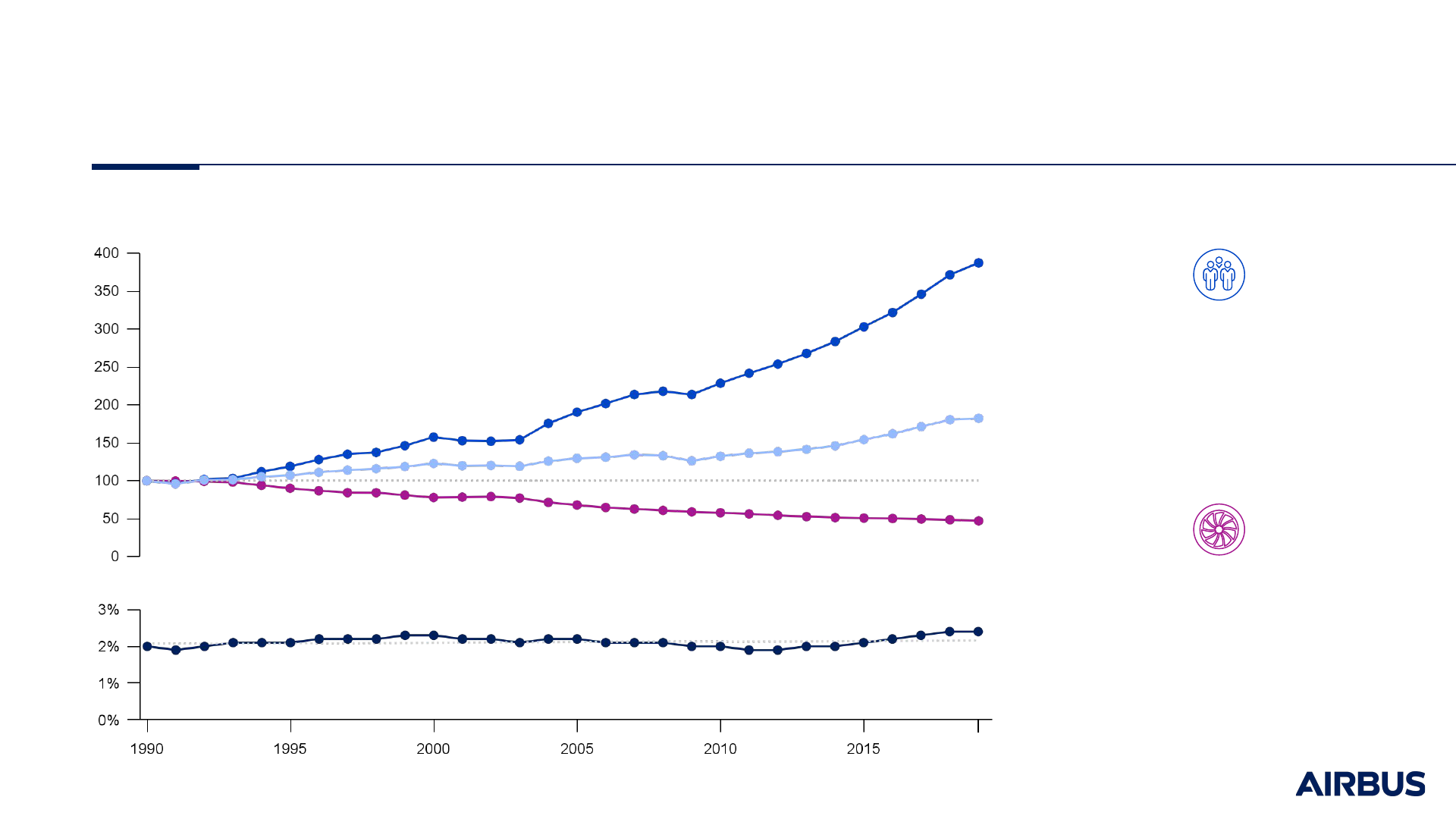

Source: IATA, ICAO, Airbus, EDGAR CO

2

emissions, Airbus GMF

* Note: commercial air transport direct share of total anthropogenic CO

2

fossil emissions (excluding land use change)

8

Index base 100 in 1990

Efficiency improvement has enabled democratisation of air travel

CO

2

emissions per RPK halved through technology and operational improvements

Air transport share

of CO

2

emissions*

Fuel burn per RPK

-2.6% per year

Fuel consumption

2.1% per year

RPKs

4.8% per year

~90 gCO

2

per

passenger kilometre

in 2019

4.5 billion

passengers carried

in 2019

2019

Airbus Global Market Forecast 2023

Share CO

2

emissions (%)

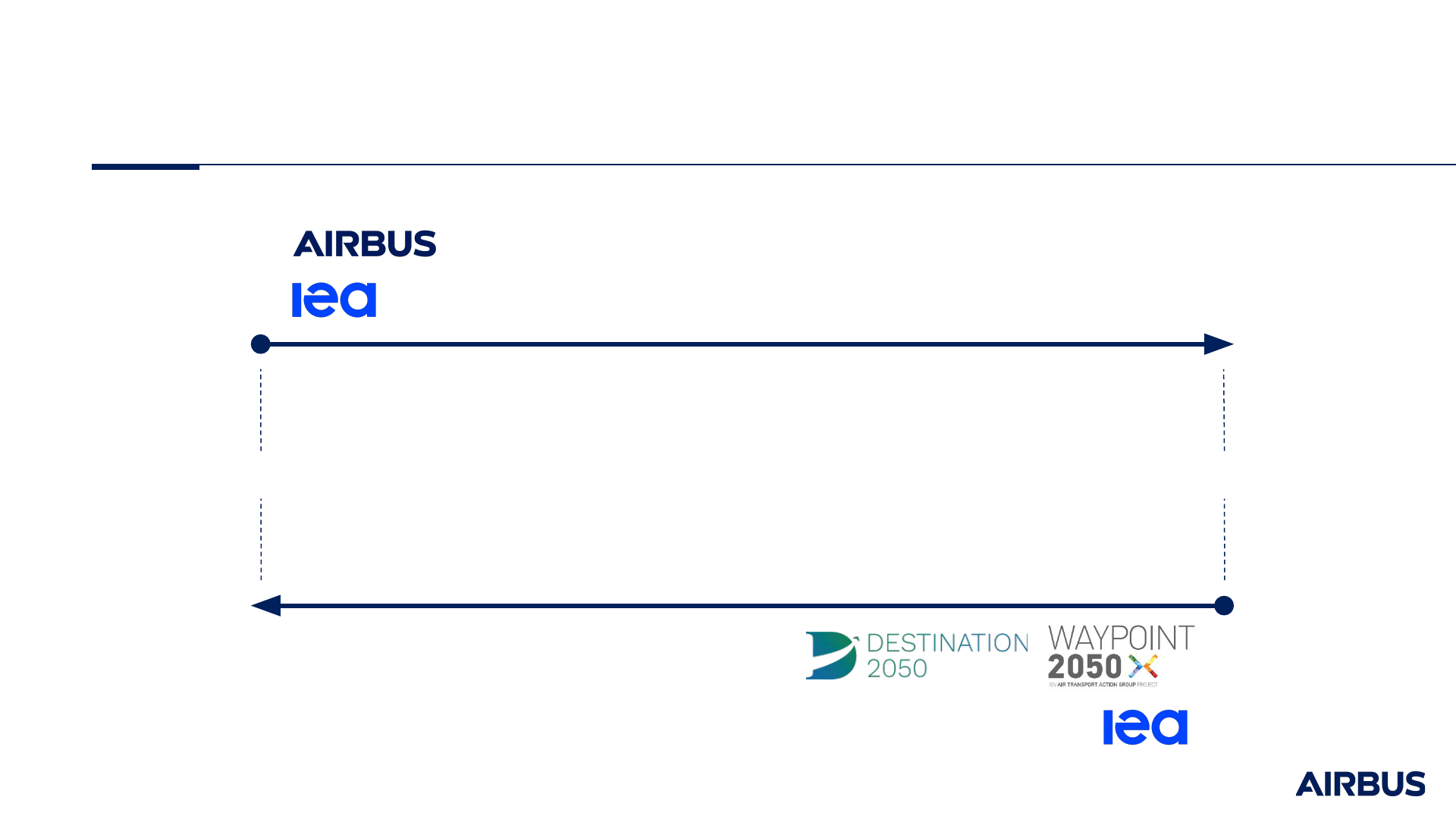

GMF23 is an exploratory scenario

Source: Airbus GMF

9

Now 2050

EXPLORATORY (forecast)

NORMATIVE (backcast)

From the

current state

of knowledge

From the

defined target

GMF 2023

STEPS - Stated Policies Scenario

APS - Announced Pledges Scenario

Sustainable Development Scenario - SDS

Net Zero Emission - NZE

Airbus Global Market Forecast 2023

Airbus Global Market Forecast 2023

Source: IHS Markit, Airbus GMF

* Households with yearly income between $20,000 and $150,000 at PPP in constant 2015 prices

10

Underlying outlook for GDP, trade and population growth

World GDP

+2.5%

CAGR 2019-2042

World trade

+2.9%

CAGR 2019-2042

Urbanisation

+1.6 bn

from 2019 to 2042

World population

+1.5 bn

from 2019 to 2042

Middle Class*

+1.9 bn

from 2019 to 2042

GDP forecast

SAF: penetration, emission reduction factor

and prices

Market-Based Measures: scope and prices

Fuel efficiency

Traffic growth scenario median at

3.6% CAGR

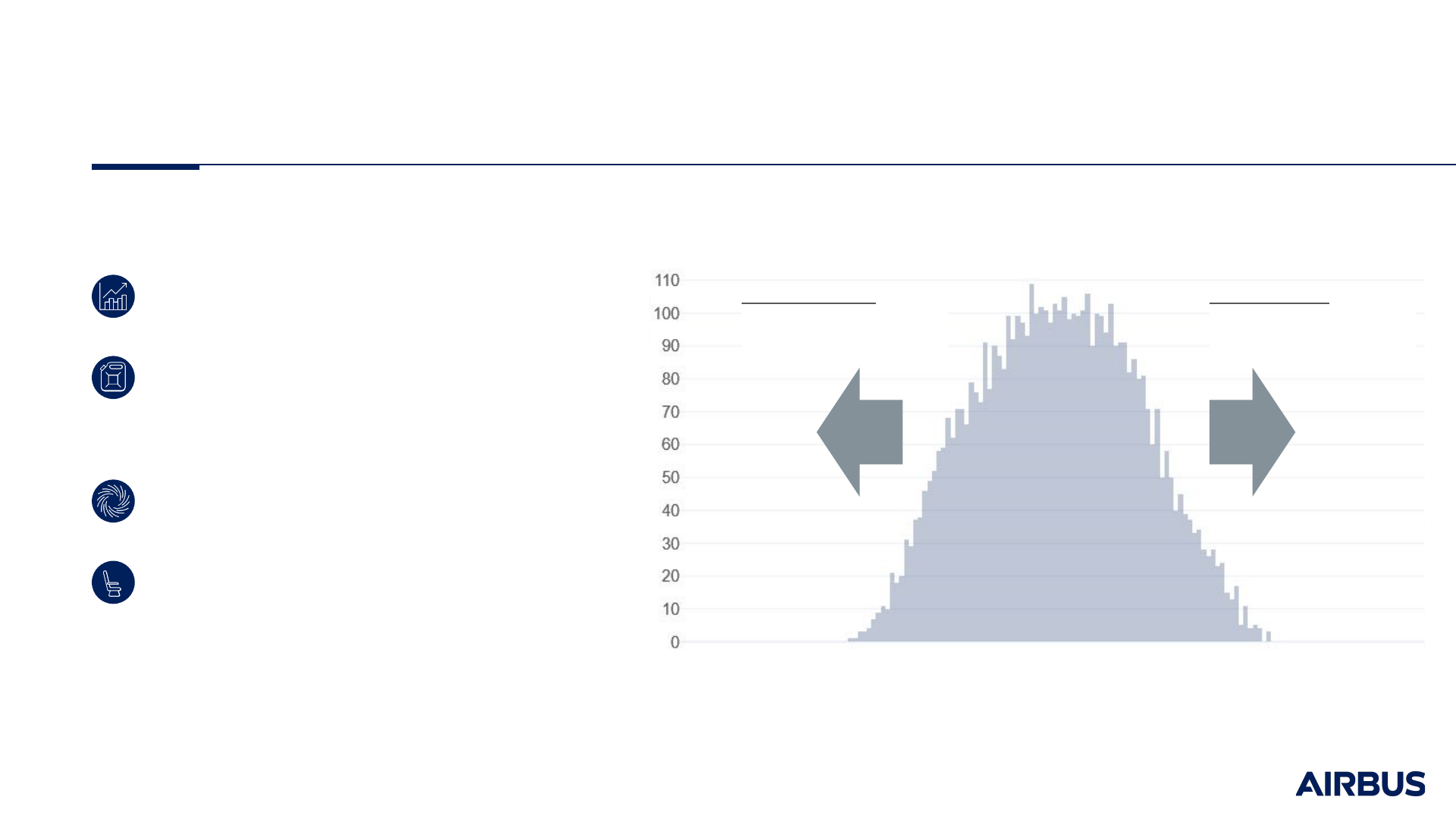

Sensitivities approach to deal with future uncertainties

Source: Airbus GMF

11

Sensitivity on key drivers

Passenger traffic 2019-2042 CAGR

Number of traffic forecast scenarios

Possible headwinds:

Environmental regulations,

energy availability, geopolitical

instability etc…

Possible tailwinds:

More stable world order,

further liberalisation, etc…

Airbus Global Market Forecast 2023

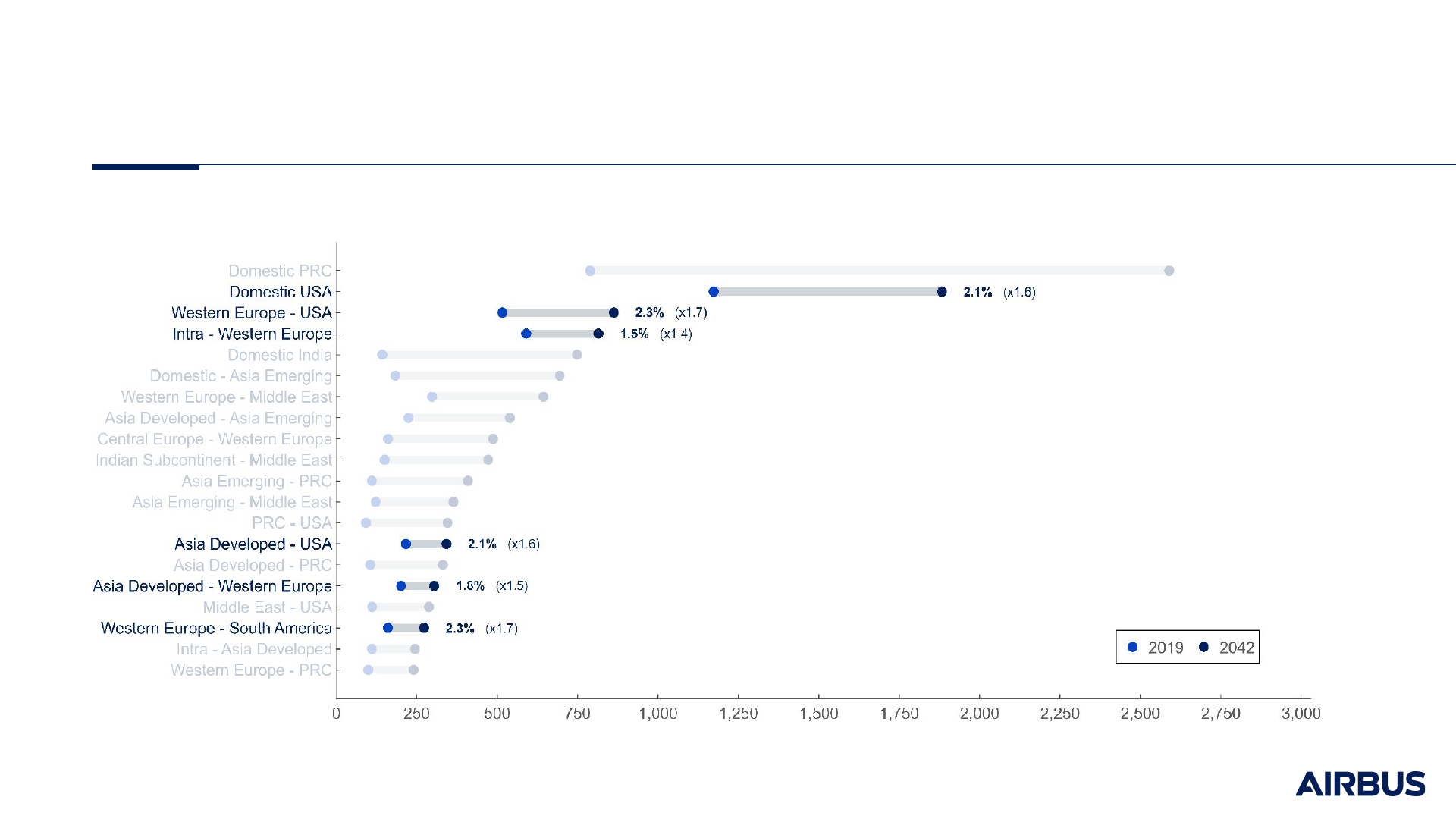

Modest growth in mature flows…

Airbus Global Market Forecast 2023

Source: Airbus GMF

12

Top 20 traffic flows (RPK)

Annual RPK (billions)

CAGR 2019-2042 (%)

Airbus Global Market Forecast 2023

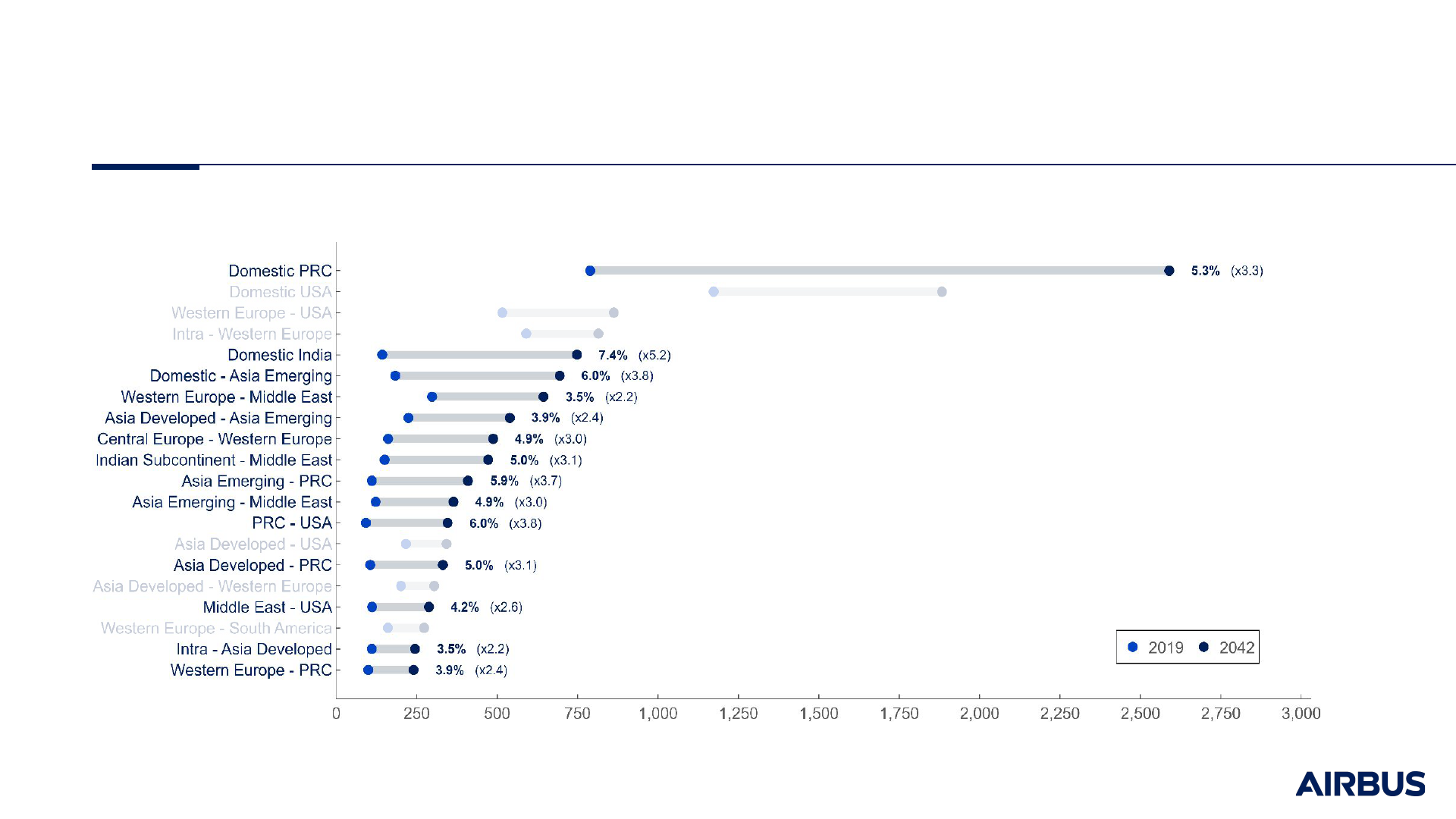

Source: Airbus GMF

13

Top 20 traffic flows (RPK)

…and stronger growth in Asia and Middle East, led by India and PRC

Annual RPK (billions)

CAGR 2019-2042 (%)

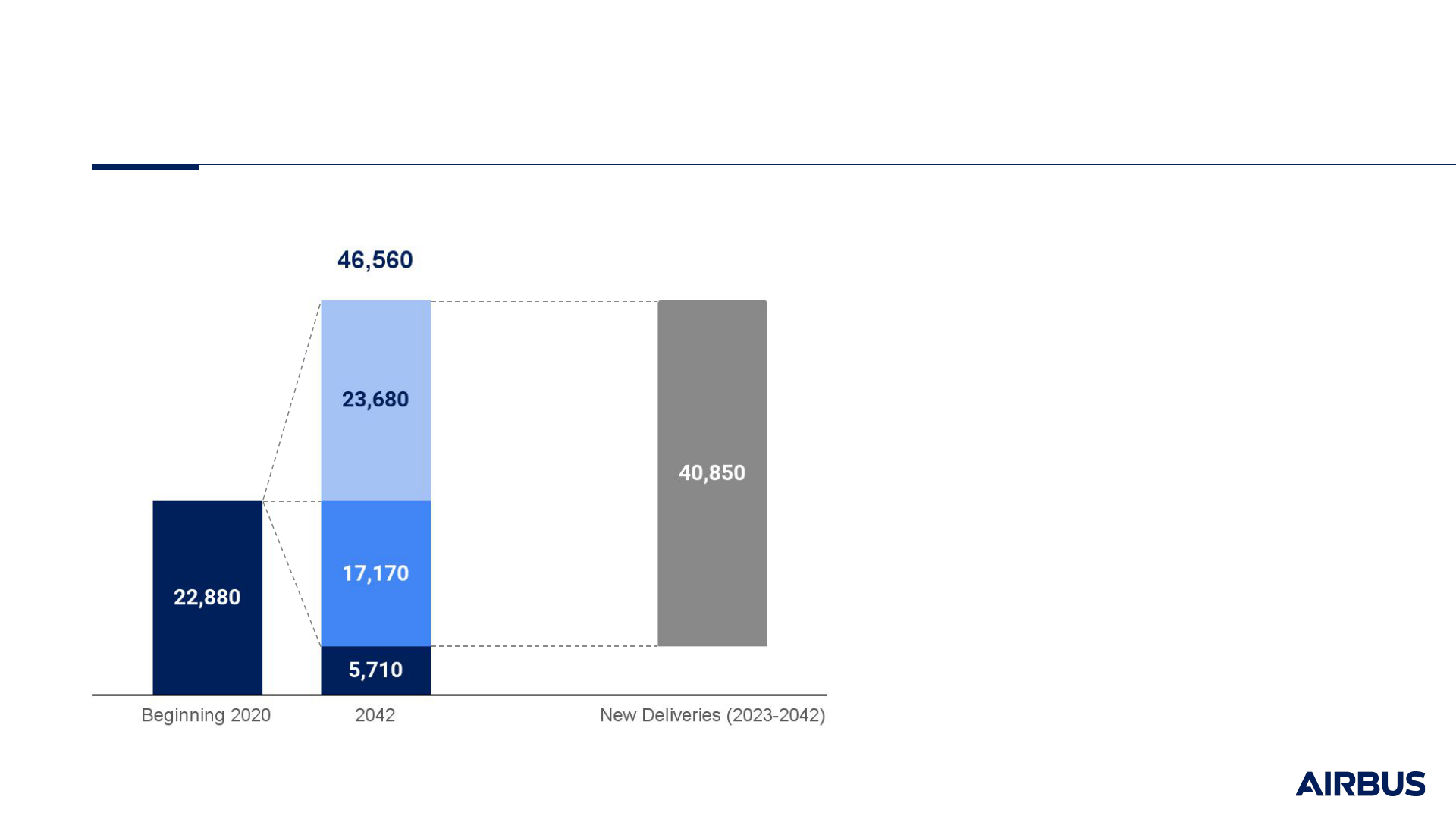

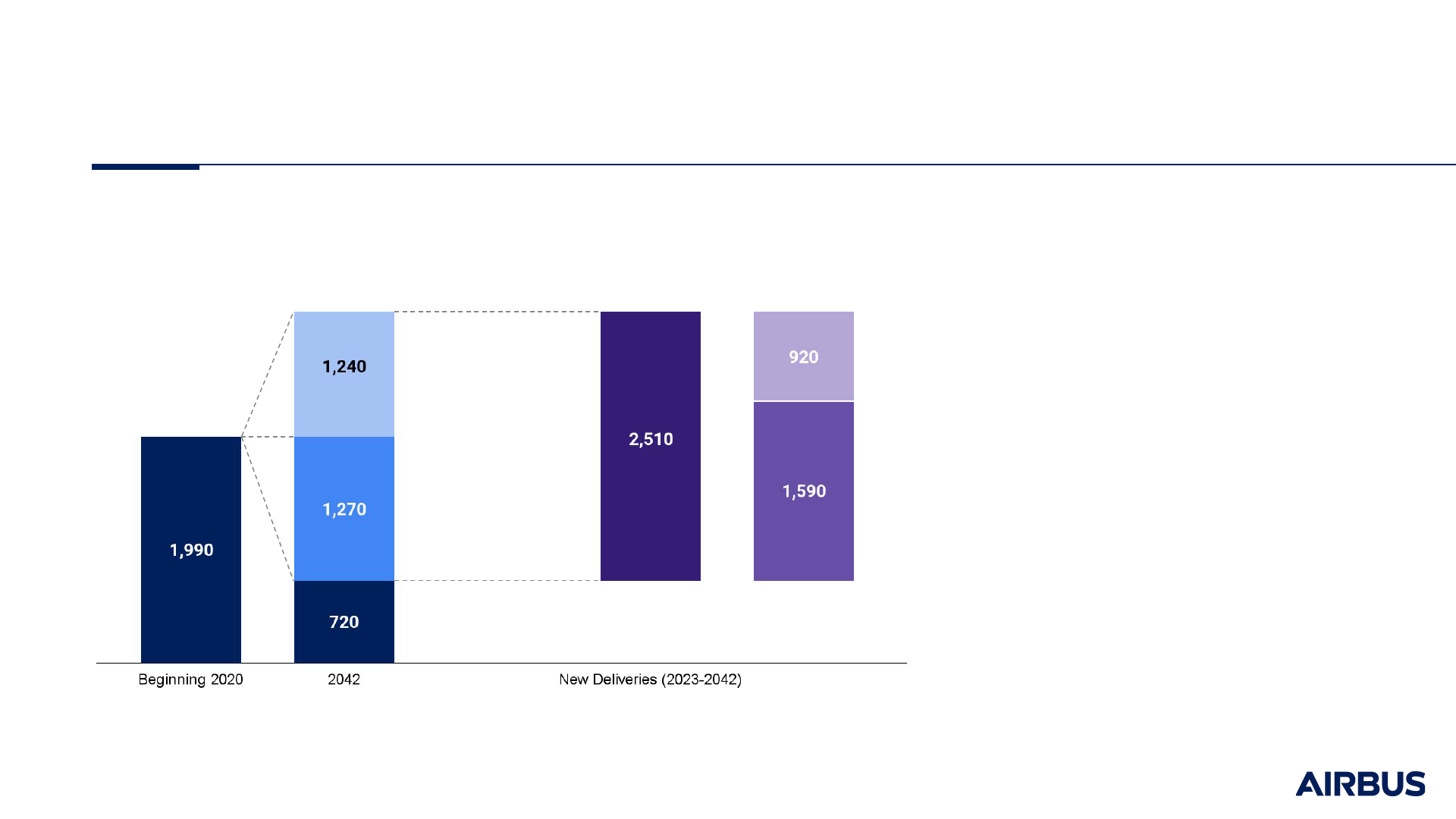

Stay

(incl. 2020-22 deliveries)

Source: Airbus GMF

Notes: Passenger aircraft above 100 seats & freighters with a payload above 10t

14

Number of aircraft

• 22,880 aircraft in-service

beginning of 2020:

– 25% will stay in-service

(including 2020-22

deliveries)

– 75% will be replaced

• 40,850 new deliveries

2023-2042:

– 58% for growth

– 42% for replacement

Grow

Replace

New deliveries

Airbus Global Market Forecast 2023

Demand for 40,850 new passenger & freighter aircraft

Demand for 40,850 new passenger & freighter aircraft over 2023-2042

Source: Airbus GMF

Note: Demand for passenger aircraft above 100 seats & freighters with a payload above 10t

32,630 aircraft

80% share of total new deliveries

8,220 aircraft (inc. 920 new-built freighters)

20% share of total new deliveries

Typically Single-Aisle Typically Widebody

Airbus Global Market Forecast 2023

15

40,850 new deliveries between 2023 and 2042

16

Airbus Global Market Forecast 2023

Source Airbus GMF

Notes: Passenger aircraft (≥ 100 seats) & Freighters (≥ 10 tons payload) | Figures rounded to nearest 10

North America

Latin America

Africa

Europe & CIS

Middle East

PRC

Asia/Pacific

(excl. PRC)

Typically Single Aisle

Typically Widebody

Express air cargo growth will outpace General air cargo

17

World air cargo traffic +3.2% CAGR 2019-2042

250 billion

FTK

2042

520 billion

FTK

2019

Express

boosted by e-commerce

+4.9%

CAGR 2019-2042

Express

25%

General 83%

General 75%

Express

17%

Source: IHS Markit, Seabury, IATA, Airbus GMF

General cargo

dominates the market

+2.7%

CAGR 2019-2042

Airbus Global Market Forecast 2023

World freighter fleet in service will reach 3,230 aircraft by 2042

18

Source: Airbus GMF

Note: Freighters with a payload above 10t

Grow

New-build

Replace

Stay

(incl. 2020-2022 deliveries)

Conversions

3,230

Airbus Global Market Forecast 2023

Number of freighter aircraft

Source: Airbus GMF

Note: Freighters with a payload above 10t

Airbus Global Market Forecast 2023

1,020 aircraft 890 aircraft 600 aircraft

Single-Aisle

(10t - 40t)

Mid-size Widebody

(40t - 80t)

Large Widebody

(> 80t)

19

Global demand for 2,510 freighters, over 2023-2042

Airlines require the latest, most efficient and lowest-emission aircraft

Fleet modernisation:

A strategic hedge against high energy costs

75% of fleet not yet latest generation

% of in-service fleet by aircraft generation

13%

25%

5%

202220192017

Source: Cirium, Airbus GMF

Passenger aircraft above 100 seats – Year end | New generation: A220, A320neo Fam., A330neo, A350, Emb-E2, 737Max, 787

Freighter

Single-Aisle Widebody

Backlog:

5,983 aircraft

Backlog:

520 aircraft

Backlog:

432 aircraft

Backlog:

187 aircraft

Backlog:

39 aircraft

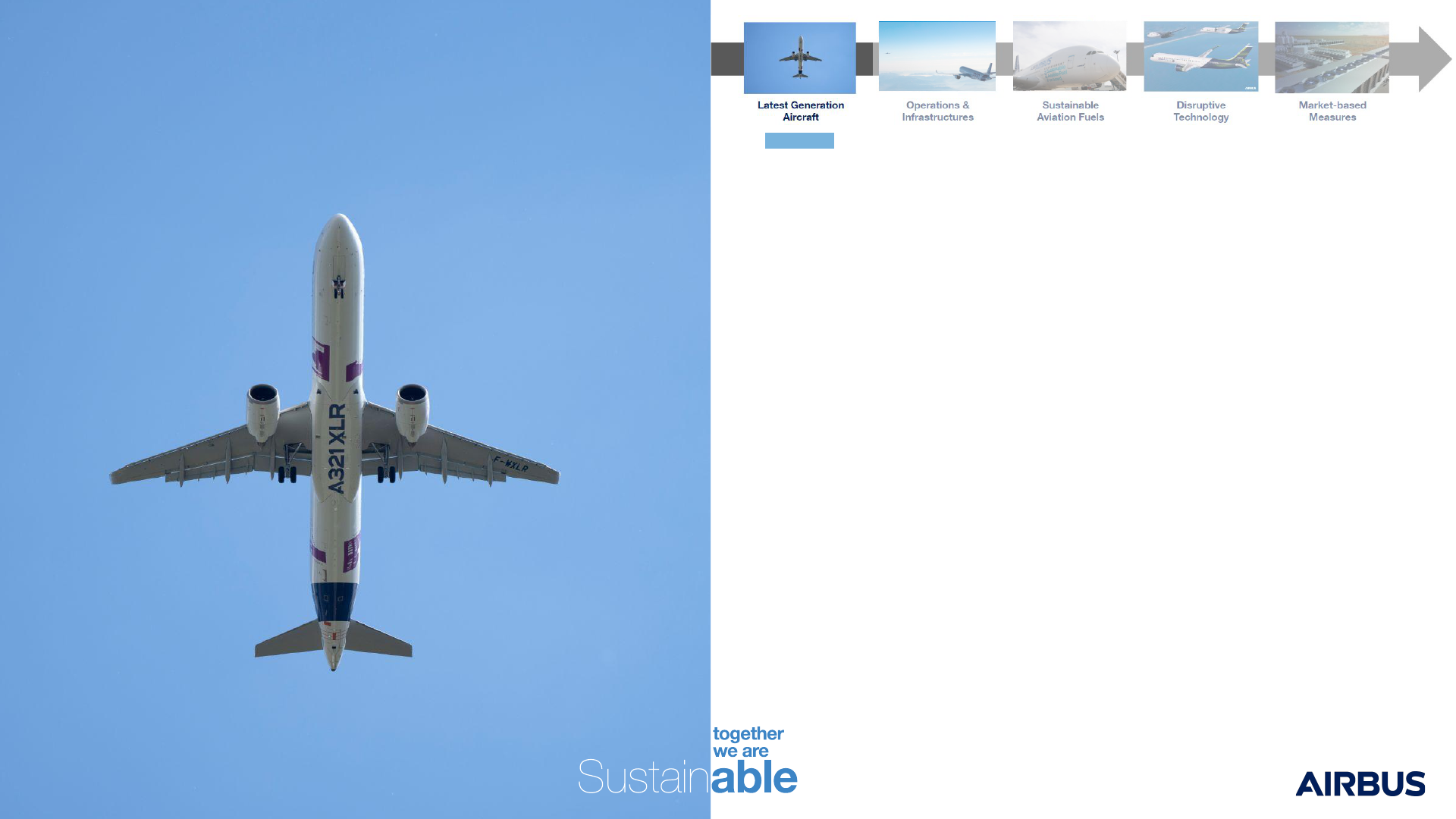

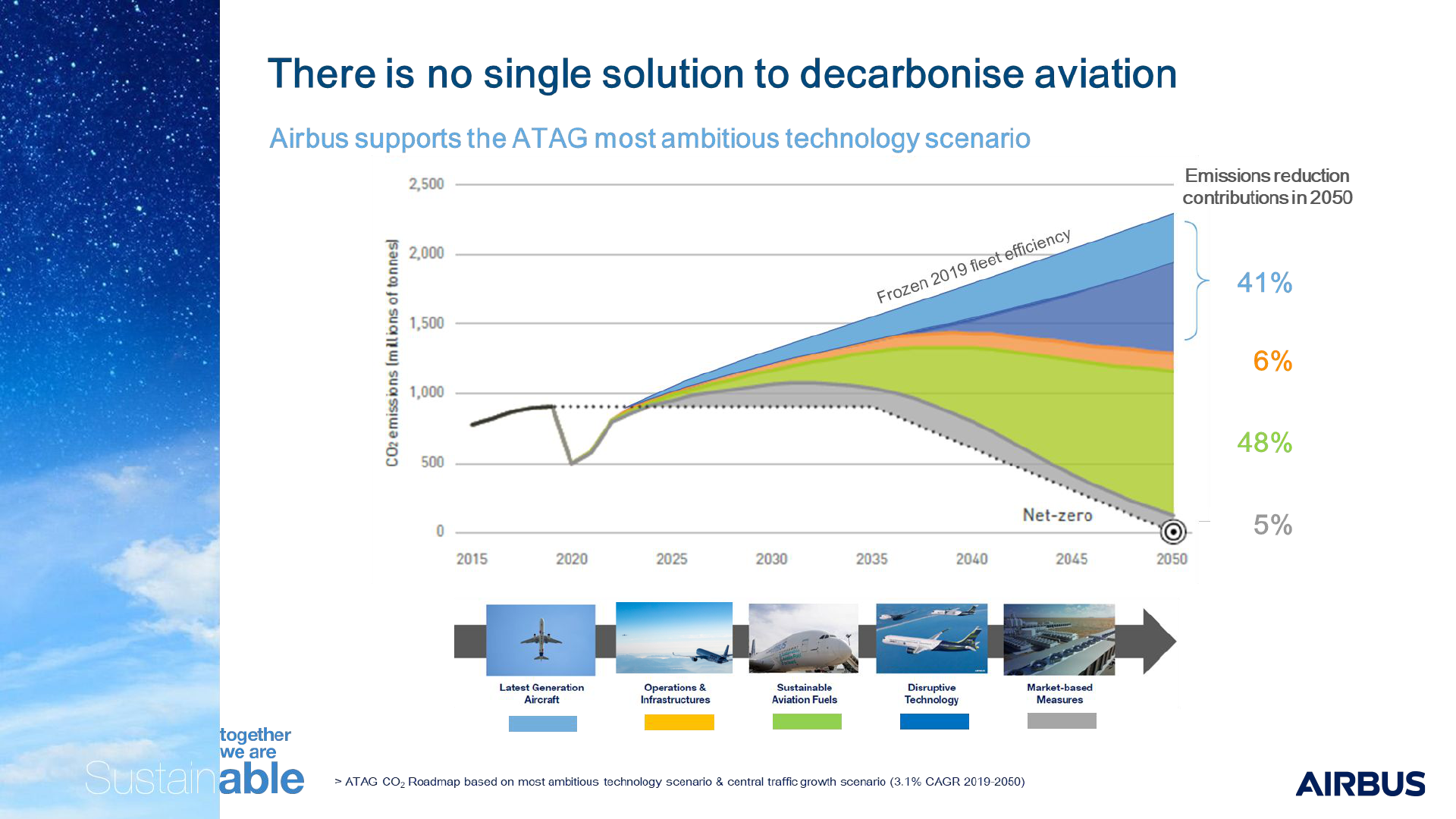

Airbus product line delivers 20 - 40% fuel burn reduction

End of May 2023

Latest generation aircraft

Operations

Sustainable Aviation Fuel

Disruptive technology

CO

2

Offsetting & Capture

Source: Airbus GMF

22

Airbus is leading aviation decarbonisation

Acting on all levers

2050+

Today

Continuous incremental improvement

Expanding upgrades / performance & trajectory

optimisation

Moving from 50 to 100% capability by 2030

Developing disruptive aerodynamics / airframe / propulsion / energy

Supporting CORSIA & carbon removals

Fleet renewal / 25% less CO

2

Services portfolio

Up to 50% SAF capability

→ Already 25% CO

2

reduction compared to previous generation aircraft

→ improving aircraft operational efficiency → Albatross

→ Fello’Fly

→ eXtra Performance Wing / ZEROe

→ DACCS scale-up and advocacy

Latest generation aircraft

● Up to 25% lower unit fuel and CO

2

vs.

previous generation - across the entire

Airbus Family

● Only 25%* of passenger in-service fleet are

latest generation aircraft

● A350F will be the first latest generation

freighter on the market

* Passenger aircraft above 100 seats – End 2022 / New generation: A220, A320neo Fam., A330neo, A350,

Emb-E2, 737Max, 787

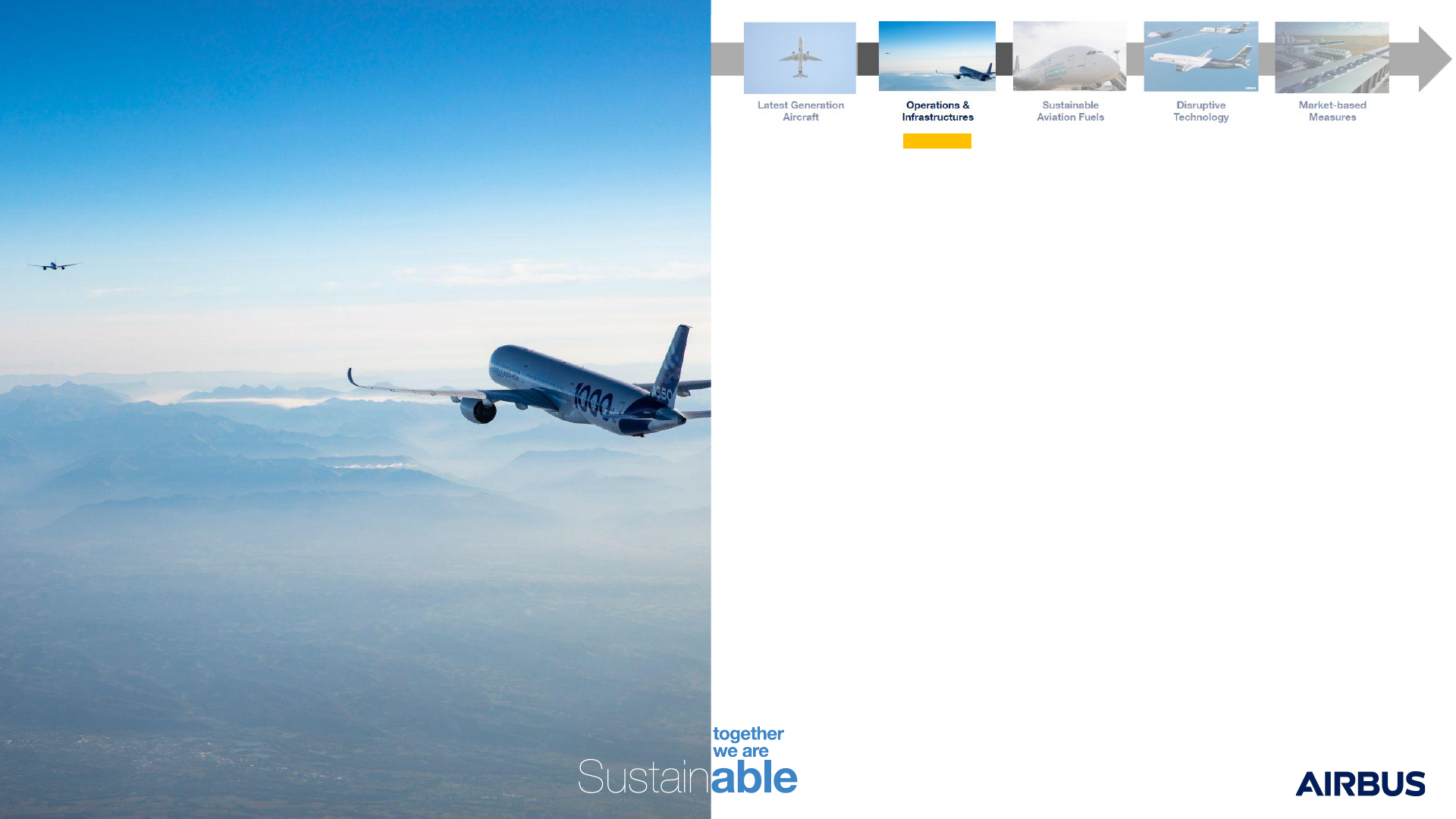

Operations & Infrastructures

● Increased efficiency of the current fleet,

by up to 10%, with a range of solutions

● Upgraded aircraft systems

● Optimized flight trajectories

● Decarbonised on-ground operations

● Air Traffic Management

Sustainable Aviation Fuels

● Flying with 100% SAF reduces lifecycle

CO

2

emissions by around 80%

● All Airbus aircraft are already certified to 50%,

certification up to 100% by end of decade

● Industrial uptake needed to increase SAF’s

availability

● Coalitions and partnerships signed to foster

production of SAF

Disruptive technologies

● Development, testing and maturity-based

deployment of advanced technologies

● Ambition to bring a zero emission aircraft to the

market by 2035

● Hydrogen as a fuel for turbines, for electric

motors via fuel cells and to produce SAF

● Developing advanced solutions for hydrogen

or kerosene fuelled aircraft (aerodynamics /

airframe / propulsion / hybridization)

Carbon removal options

Nature-based solutions

● Widely used as offsets for

compensation in voluntary and

regulated markets

Point-Source Carbon Capture

● Emerging technology

● Competes with other industries

● Necessary as a transition solution

to develop synthetic fuels at scale

Direct Air Carbon Capture

● Emerging technology

● Enables credits from CO2 storage

and CO2 as feedstock for synthetic

fuels

● Carbon credits from storage can

only be used on voluntary markets

or local carbon markets

Airbus Global Market Forecast 2023

Source: Airbus GMF

Takeaways

29

Passenger Traffic

2019-2042 CAGR

Freight Traffic

2019-2042 CAGR

Fleet in service

beginning of 2020

Fleet in service in 2042

New deliveries 2023-2042

3.6%

3.2%

22,880 aircraft

46,560 aircraft

40,850 aircraft

© AIRBUS (Airbus S.A.S., Airbus Operations S.A.S., Airbus Operations GmbH, Airbus

Operations LTD, Airbus Operations SL, Airbus China LTD, Airbus (Tianjin) Final Assembly

Company LTD, Airbus (Tianjin) Delivery Centre LTD). All rights reserved. Confidential and

proprietary document. This document and all information contained herein is the sole property

of AIRBUS. No intellectual property rights are granted by the delivery of this document or the

disclosure of its content. This document shall not be reproduced or disclosed to a third party

without the express written consent of AIRBUS S.A.S. This document and its content shall not

be used for any purpose other than that for which it is supplied. The statements made herein

do not constitute an offer. They are based on the mentioned assumptions and are expressed

in good faith. Where the supporting grounds for these statements are not shown, AIRBUS

S.A.S. will be pleased to explain the basis thereof. AIRBUS, its logo, A220, A300, A310, A318,

A319, A320, A321, A330, A340, A350, A380, A400M are registered trademarks.