John Leahy

Chief Operating Officer, Customers

Growing Horizons

Global Market Forecast

2017 - 2036

Global Market Forecast 2017: Highlights

Notes: Passenger aircraft (≥ 100 seats) | Jet freight aircraft (>10 tonnes)

Source: Airbus GMF 2017

2

World Fleet Forecast 2016 2036

RPK (trillions) 7.0 16.5

Passenger Aircraft Fleet 18,890 40,120

New passenger aircraft

deliveries

34,166

Dedicated Freighters 1,610 2,410

New freighter aircraft

deliveries

733

Total New Aircraft Deliveries

34,899

vs.

GMF16

+3.1%

+6.4%

+1,741

% change

2016-2036

135%

112%

50%

+88

+14.2%

+1,829

20-year demand for almost 35,000 new passenger and freighter aircraft

Notes: Passenger aircraft (≥ 100 seats) | Jet freight aircraft (>10 tonnes)

Source: Airbus GMF 2017

3

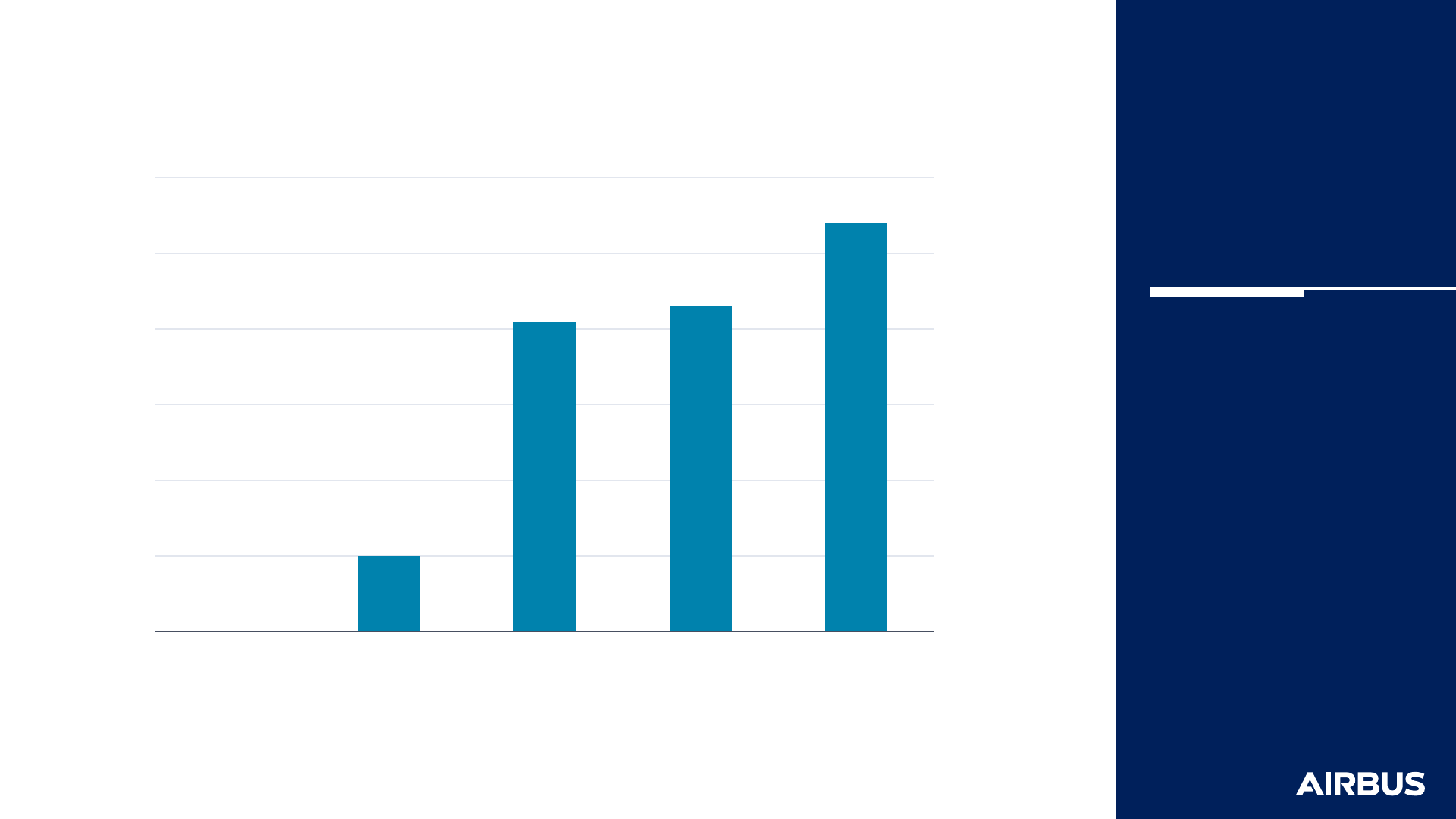

34,899 new aircraft

24,807 single-aisle aircraft

8,686 twin-aisle aircraft

1,406 very large aircraft

5.3

$US trillion

+1,277 vs GMF 2016

+626

-74

+1,829

Single-aisle represent 71% of units, and widebodies represent 54% of value

Notes: Passenger aircraft (≥ 100 seats) | Jet freight aircraft (>10 tonnes), Rounded figures to the nearest 10

Source: Airbus GMF 2017

4

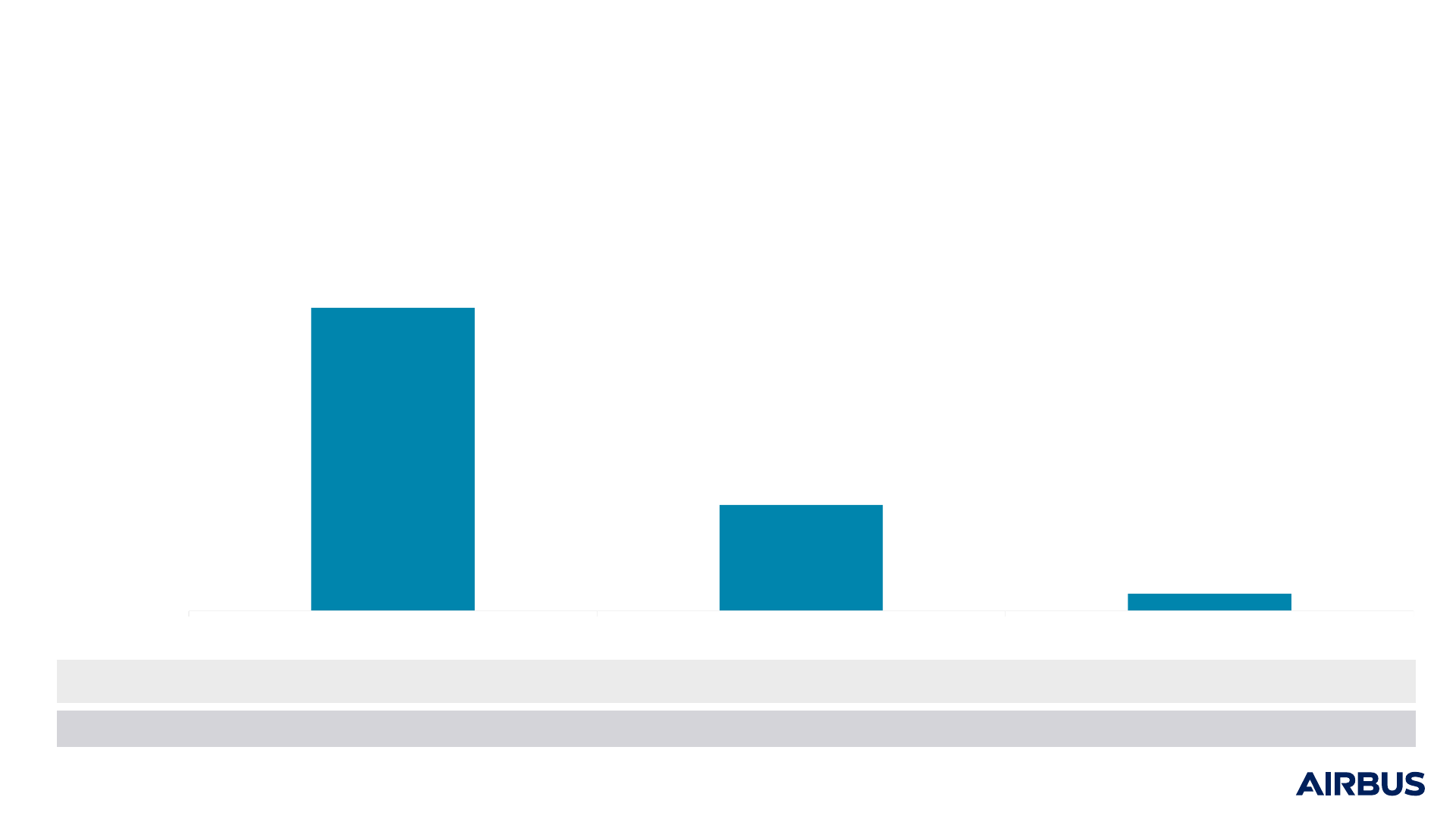

Number of aircraft

24,810

8,690

1,410

0

5,000

10,000

15,000

20,000

25,000

30,000

Single-aisle Twin-aisle Very Large Aircraft

% units

71% 25% 4%

% value

46% 44% 10%

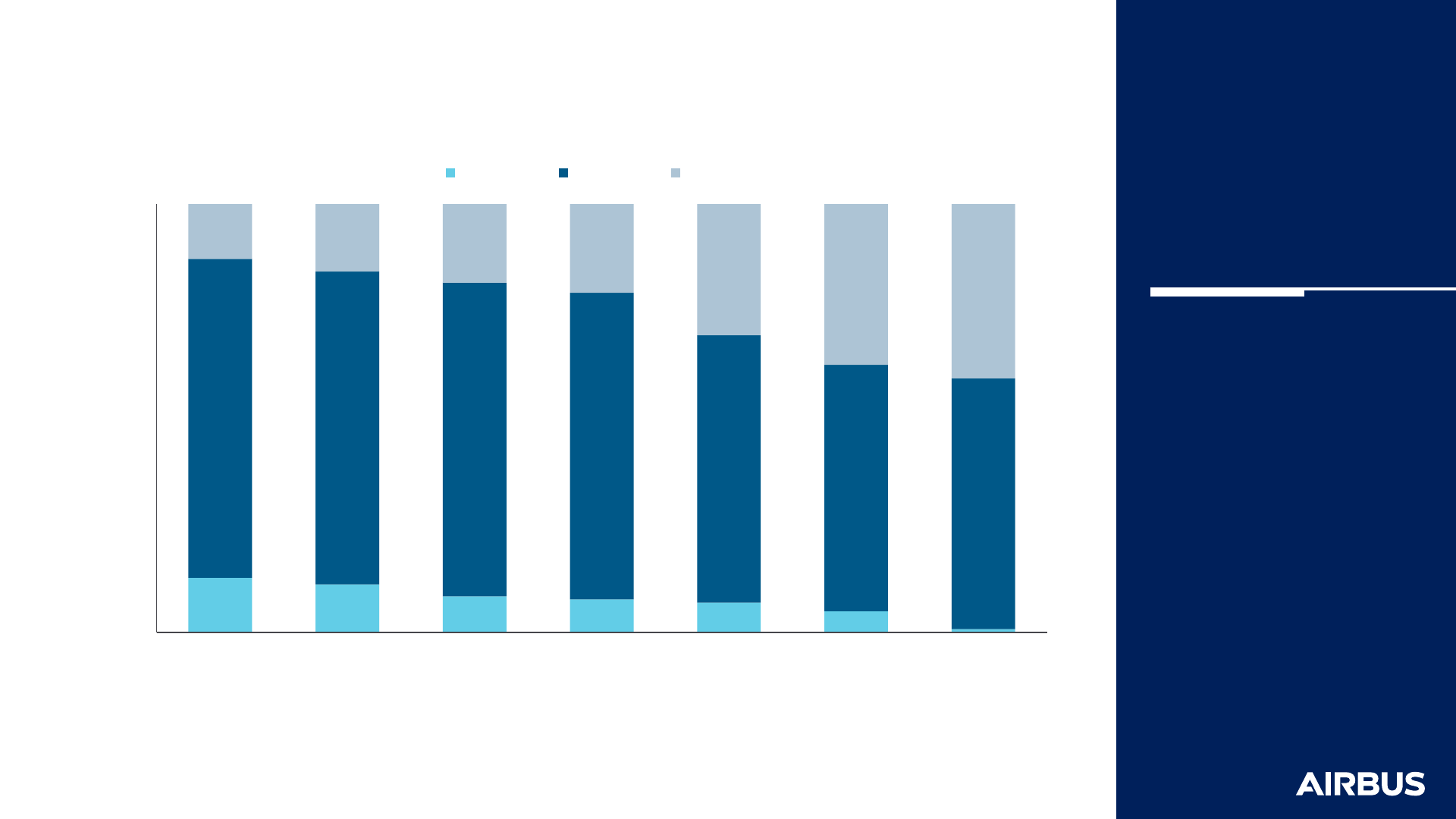

Fleet in service evolution

Notes: Passenger aircraft (≥ 100 seats) | Jet freight aircraft (>10 tonnes), Rounded figures to the nearest 10

Source: Airbus GMF 2017

5

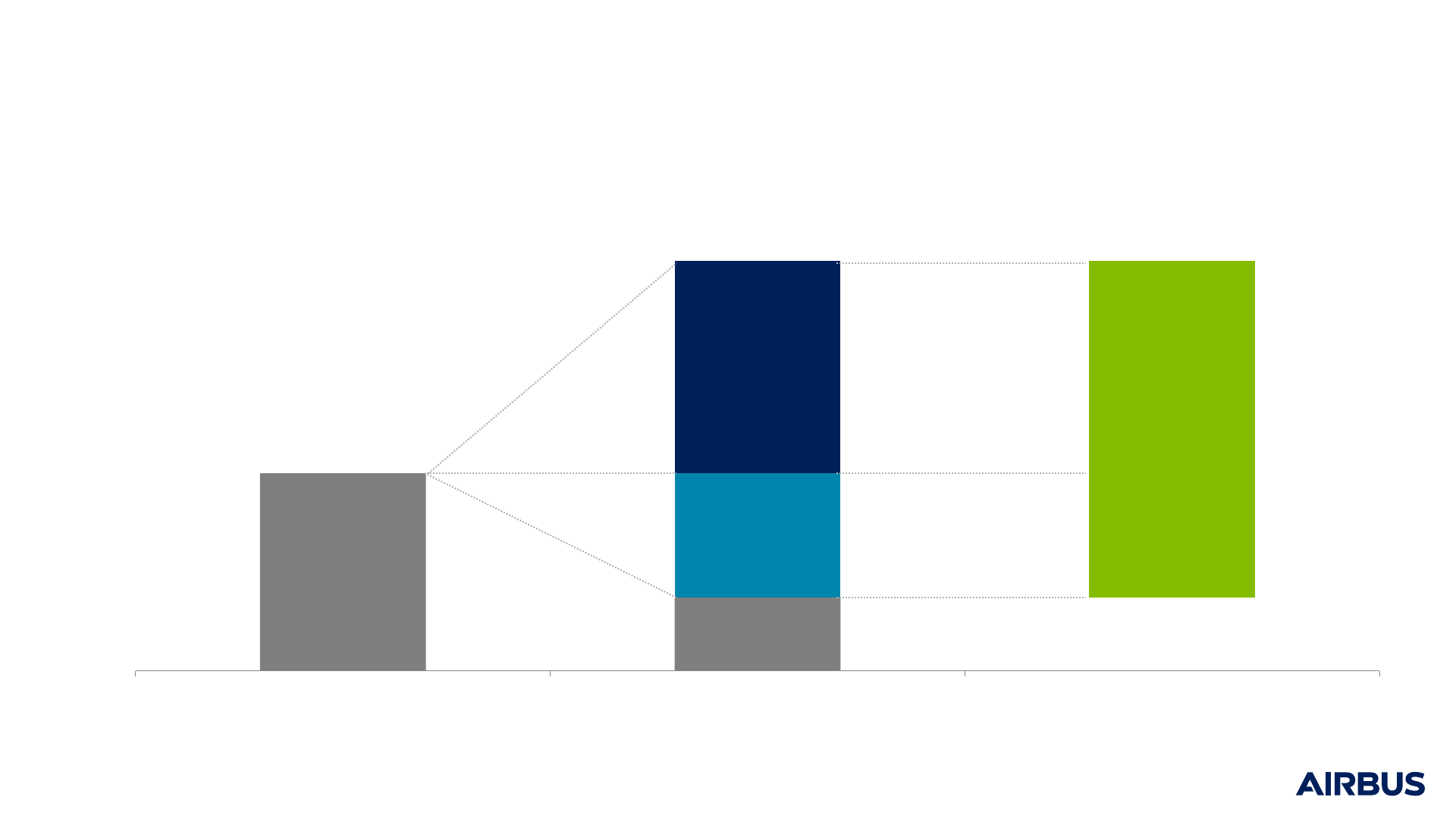

Number of aircraft*

20,500

7,630

12,870

22,030

34,900

-

5,000

10,000

15,000

20,000

25,000

30,000

35,000

40,000

45,000

Beginning 2017 2036 New Deliveries

20-year

new deliveries

Replacement

Growth

Stay

2016 was a good year

20

42

64

78

0

10

20

30

40

50

60

70

80

90

<0% [0% - 5%] [5% - 10%] >10%

Source: ICAO, OAG, IHS Economics, Airbus GMF

6

Number of countries

% - ASK growth 2015-2016

142 countries

81% of world population

88% of world GDP

World load factors remain at record levels

Source: ICAO, OAG, IHS Economics, Airbus GMF

7

World passenger load factor - %

60%

65%

70%

75%

80%

85%

1996 2001 2006 2011 2016

80%

69%

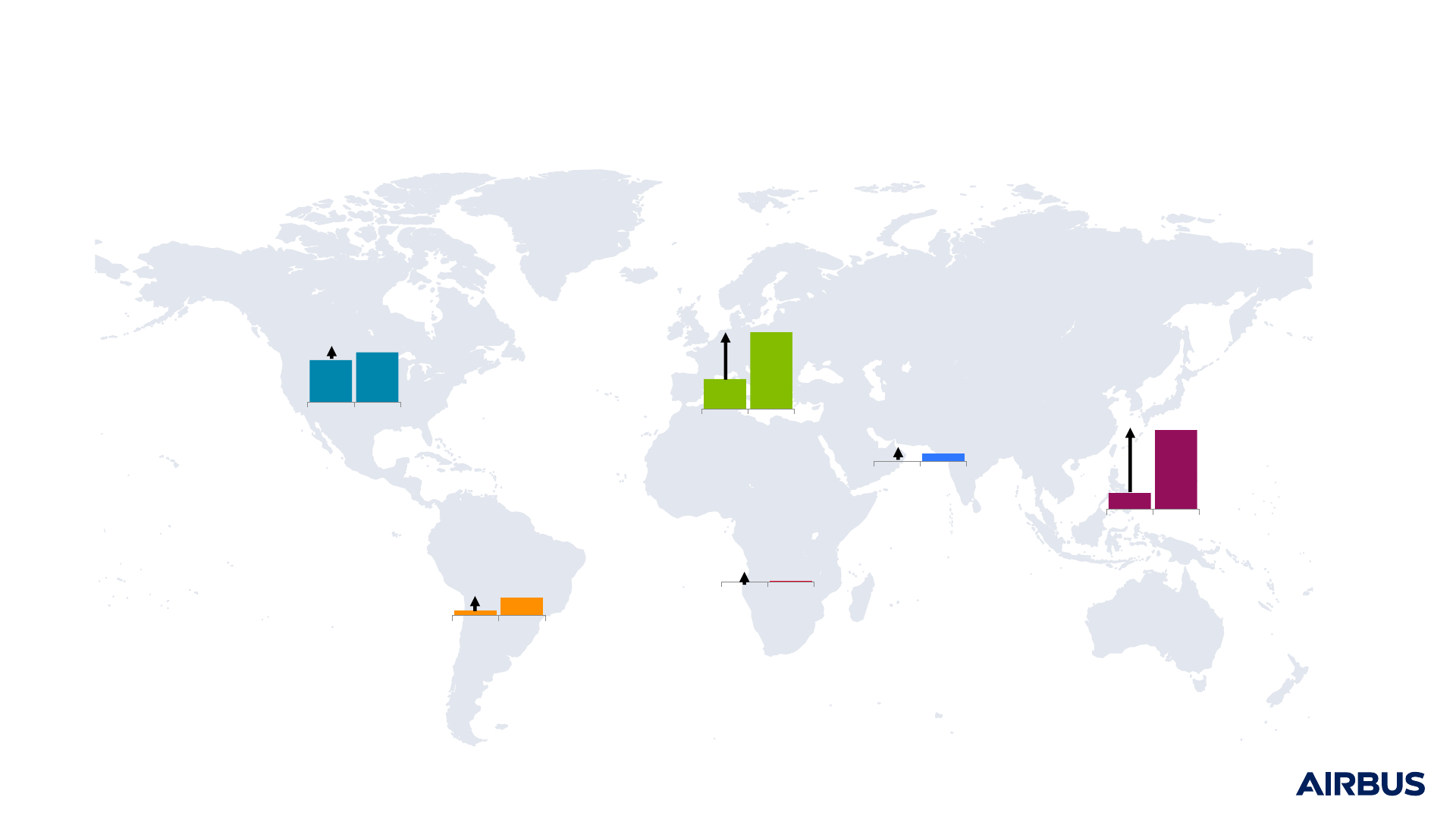

Air transport growth is highest in expanding regions

Source: IHS Economics, Airbus GMF 2017

8

Yearly RPK growth

2016 - 2036

Emerging/Developing

China

India

Middle East

Rest of Asia

Africa

CIS

Latin America

Central Europe

+5.8 %

Advanced

Western Europe

Israel

North America

Japan

Singapore

South Korea

Australia/New Zealand

+3.2 %

1

billion people

in 2016

6.4

billion people

in 2016

781

828

850

865

859

73

144

216

322

456

501

981

1,822

2,695

3,624

0

1,000

2,000

3,000

4,000

5,000

6,000

1996e** 2006 2016 2026 2036

Middle Class to almost double over the next 20 years

Rounded total to nearest 50

* Households with yearly income between $20,000 and $150,000 at PPP in constant 2016 prices

** Estimate for 1996 split by region

Source: Oxford Economics, Airbus GMF

9

People in Middle Class* (million)

Emerging countries

Developing countries

Advanced countries

8,900

56%

World Population (M.)

% of world population

8,200

47%

7,430

39%

6,600

30%

5,820

23%

Forecast

4,950

3,900

2,900

1,950

1,350

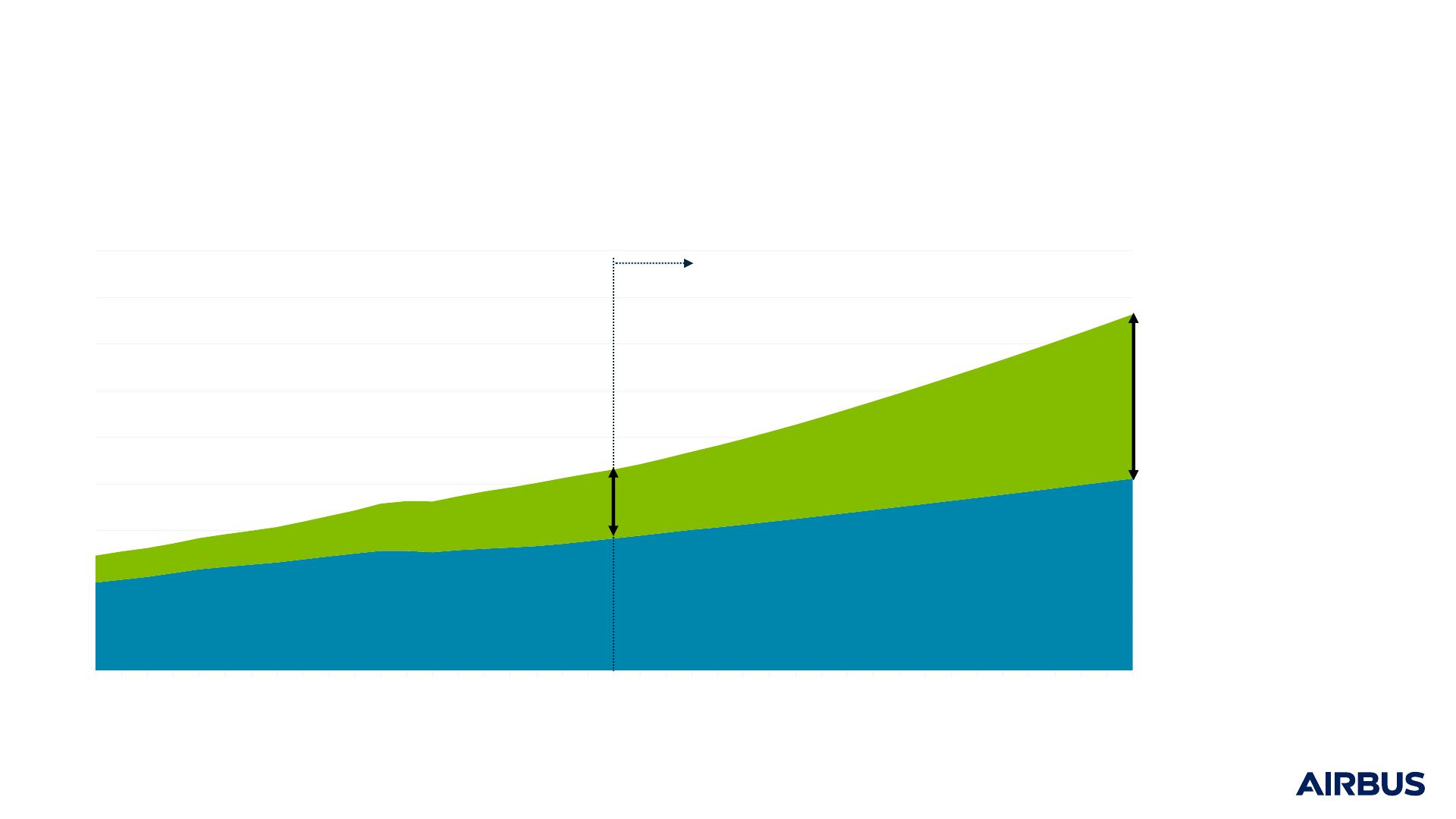

Almost 50% of world’s private consumption to come from emerging markets

Source: IHS Economics, Airbus GMF 10

World private consumption (trillion 2010 $US)

0

10

20

30

40

50

60

70

80

90

1996 2000 2004 2008 2012 2016 2020 2024 2028 2032 2036

Forecast

Advanced countries

54%

66%

77%

Emerging/Developing

countries

34%

23%

46%

0

200

400

600

800

1,000

1,200

1,400

1,600

1,800

2,000

2,200

2,400

2,600

2006 2011 2016 2021 2026 2031 2036

~60% of international tourists to be transported by air in 2036

Source: UNWTO, Sabre GDD, Airbus GMF 11

International tourist arrivals (million)

>1.2bn tourists

Forecast

48%

Share of tourists travelling by air

51%

54%

57%

>2.4bn tourists

59% 61%

62%

Tourism by Air

Tourism by surface

(Road , Water, Rail)

Low Cost Carrier market penetration has increased significantly since 2006

Source: OAG – September of each year, Airbus GMF

12

North America

Europe-CIS

Asia-Pacific

Middle East

Africa

Latin America

2006 2016

2006 2016

2006 2016

2006 2016

2006 2016

2006 2016

Low Cost Carrier seats offered on domestic and intra-regional flights (million)

38m

>39m

25m

9m

4m

0.6m

x1.2

x2.6

x4.8

x3.9

x16.4

x5.7

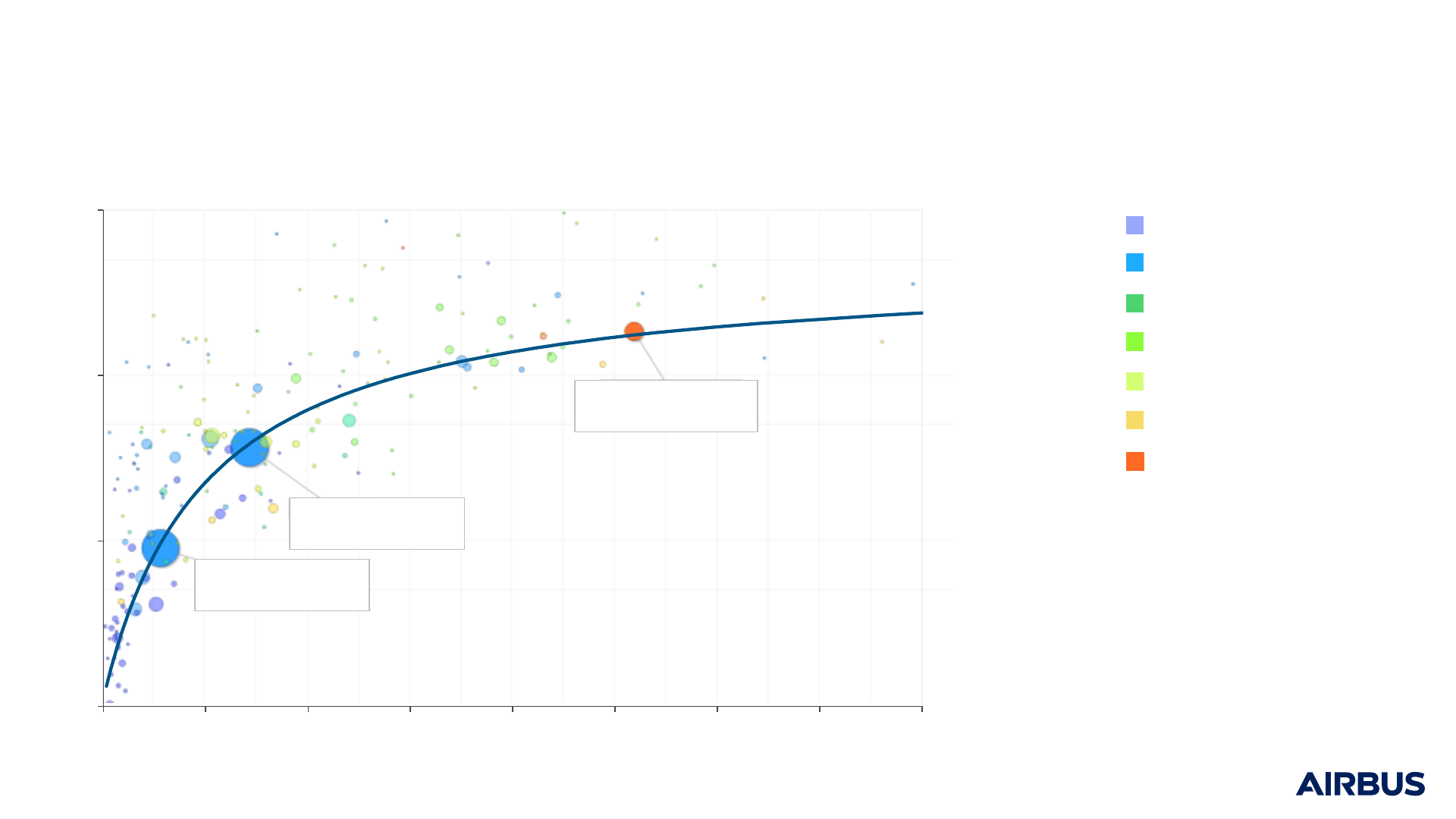

~30% of the people from emerging countries took a flight in 2016…

Source: Sabre, IHS Economics, Airbus GMF 2017

13

2016 trips per capita

2016 real GDP per capita

(2010 $US thousands at Purchasing Power Parity)

Africa

Asia/Pacific

CIS

Europe

Latin America

Middle East

North America

0.01

0.1

1

10

0 10 20 30 40 50 60 70 80

India, 2016

0.1 trips per capita

India, 2016

0.1 trips per capita

China, 2016

0.4 trips per capita

United States, 2016

1.8 trips per capita

Bubble size proportional to population

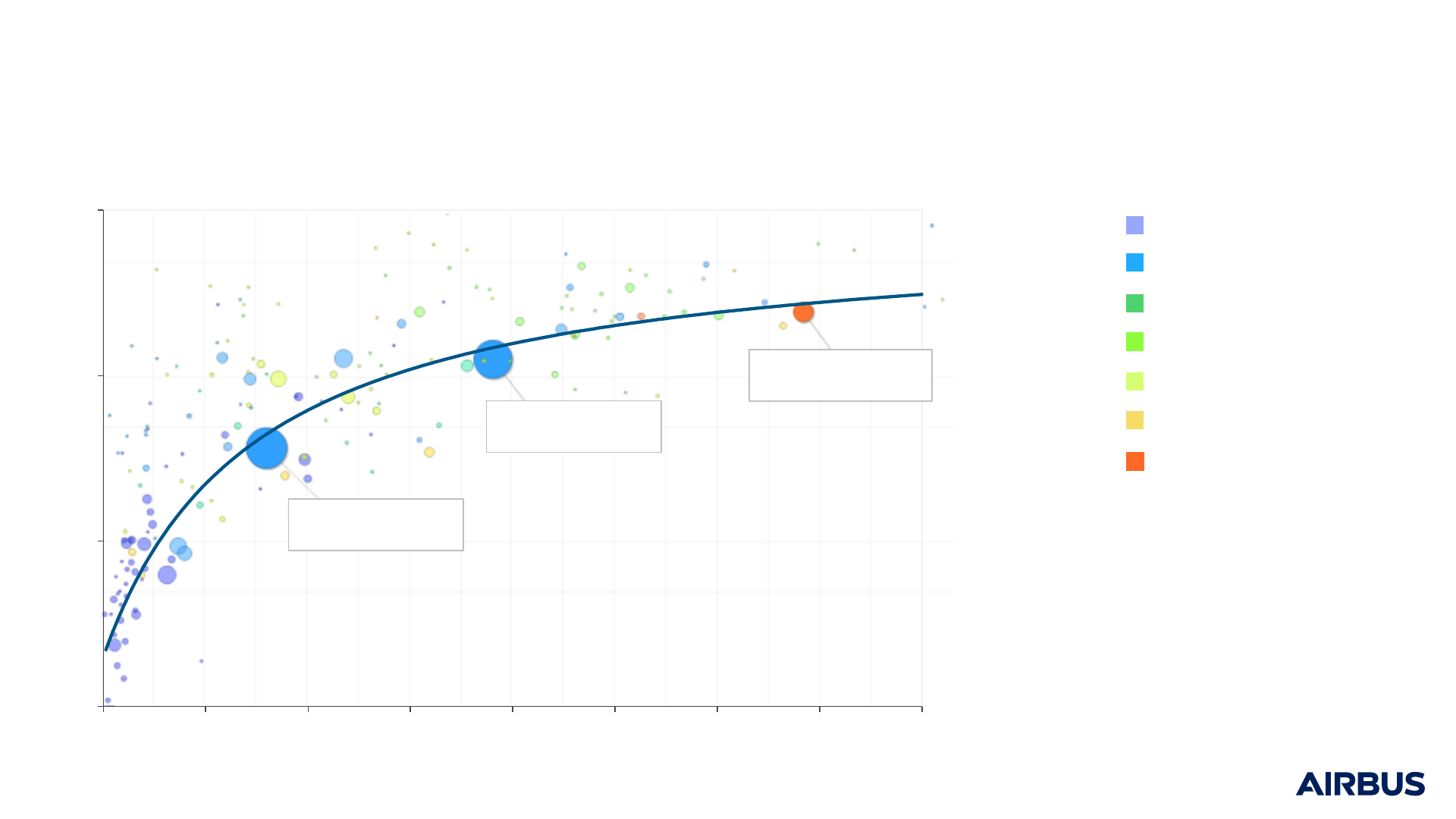

… in 2036, it will be 83%

Sources: Sabre, IHS Economics, Airbus GMF 2017

14

Africa

Asia/Pacific

CIS

Europe

Latin America

Middle East

North America

0.01

0.1

1

10

0 10 20 30 40 50 60 70 80

2036 trips per capita

2036 real GDP per capita

(2010 $US thousands at Purchasing Power Parity)

India, 2036

0.4 trips per capita

China, 2036

1.3 trips per capita

United States, 2036

2.5 trips per capita

Bubble size proportional to population

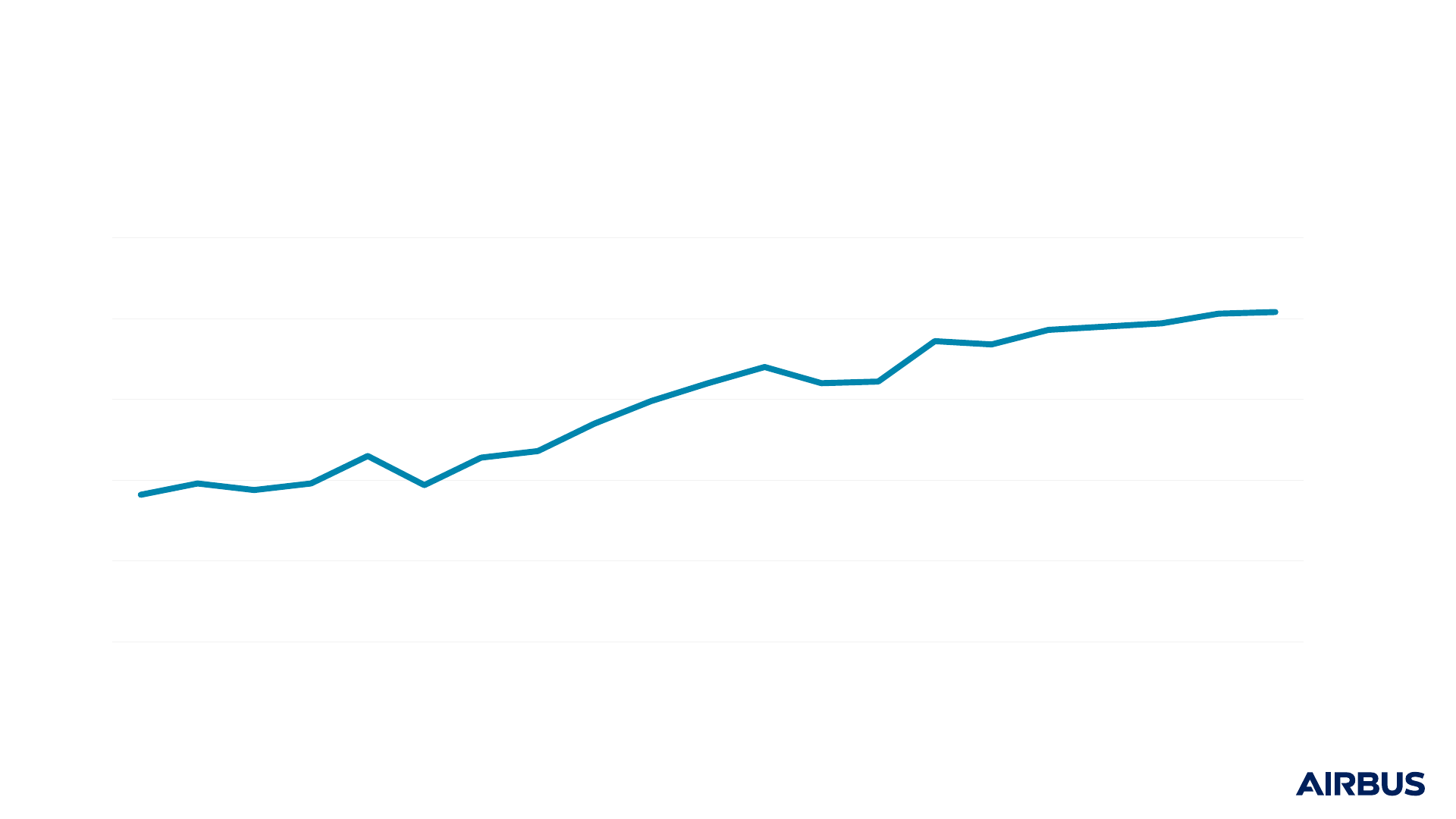

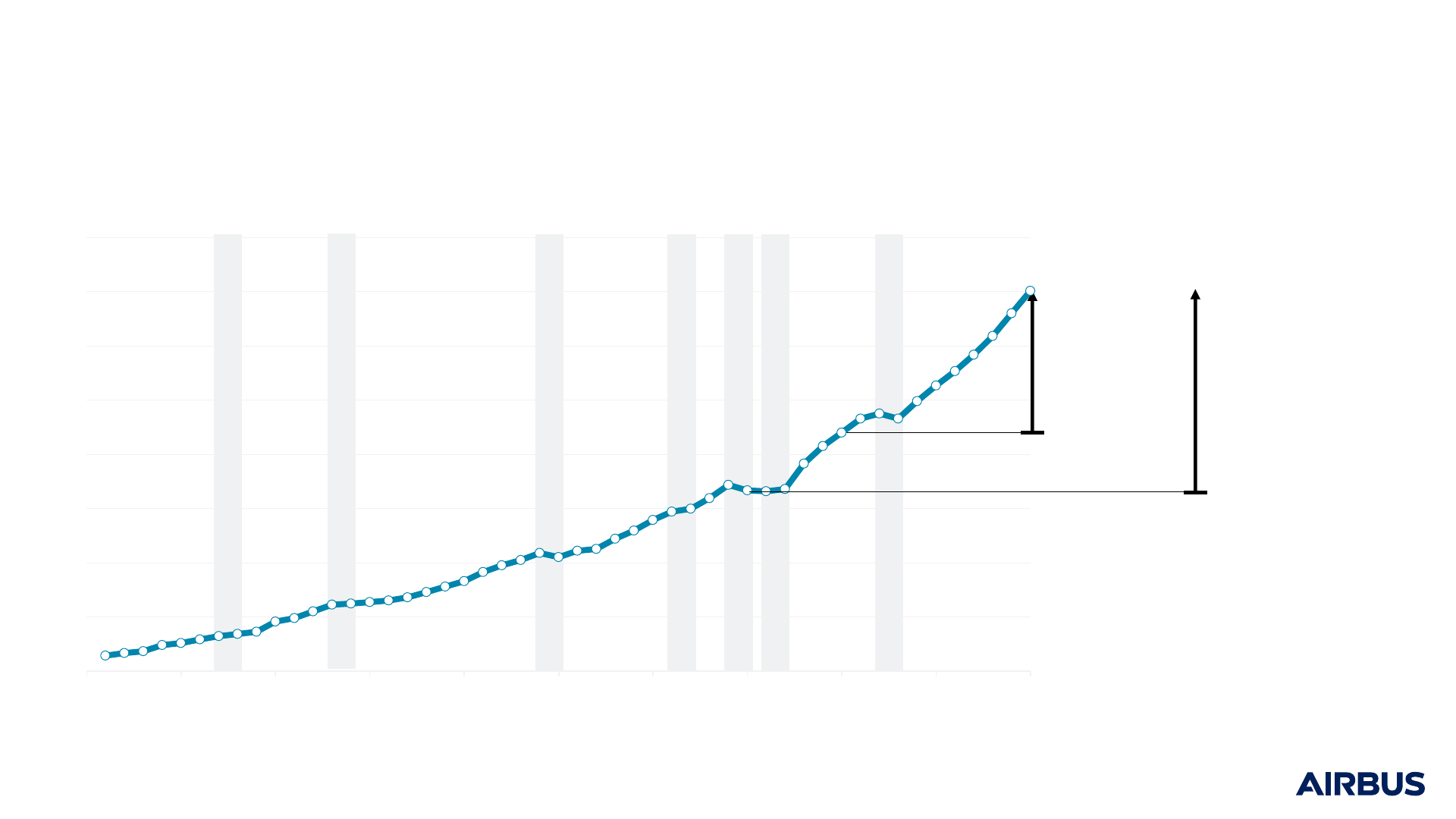

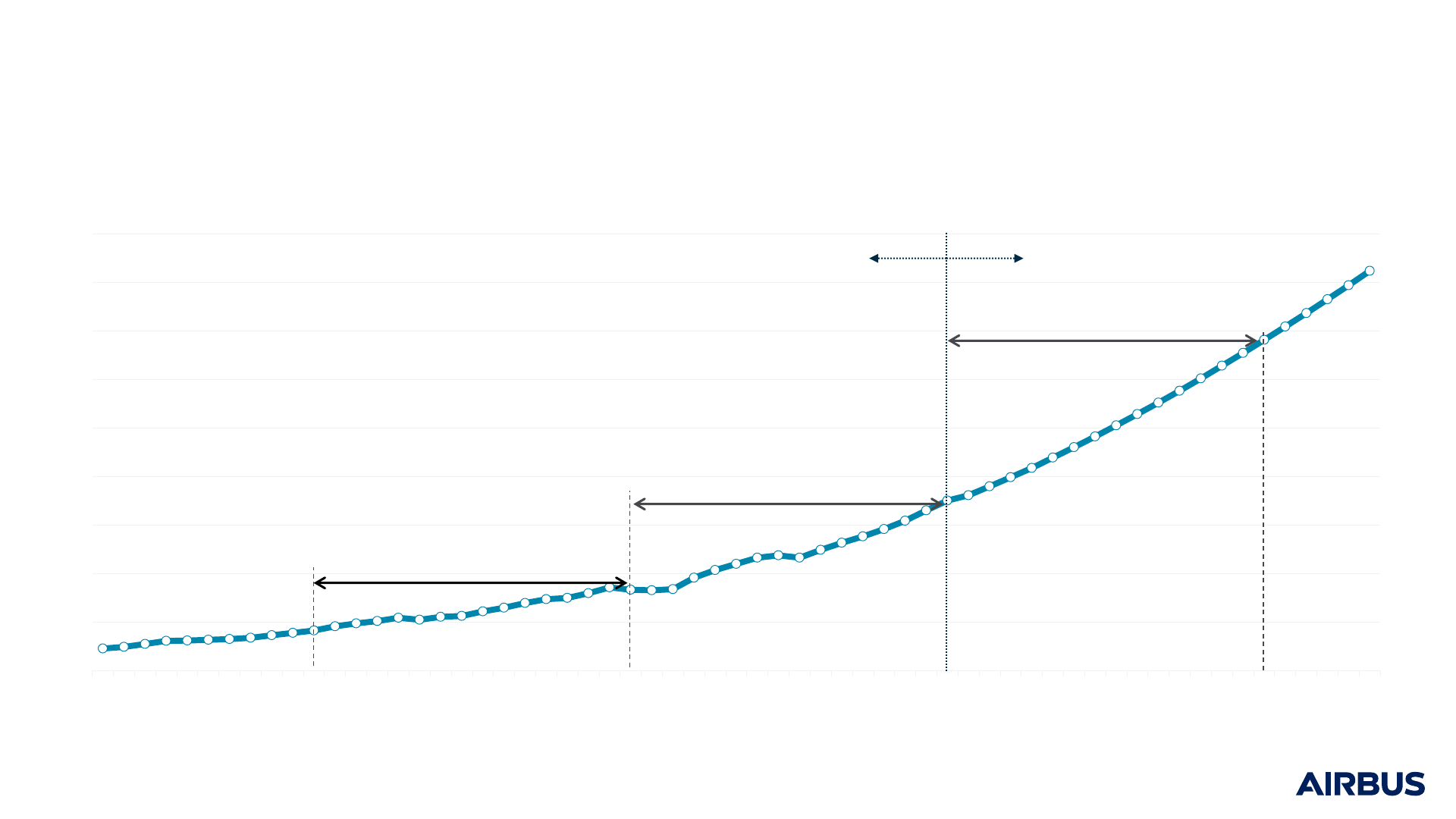

Air travel has proved to be resilient to external shocks

RPK = Revenue Passenger Kilometre

Source: ICAO, Airbus GMF

15

World annual traffic (trillion RPKs)

Oil Crisis Gulf Crisis Oil Crisis

Asian

Crisis

WTC

Attack

SARS

Financial

Crisis

x2

since 9/11

+60%

growth over the

last 10 years

0

1

2

3

4

5

6

7

8

1966 1971 1976 1981 1986 1991 1996 2001 2006 2011 2016

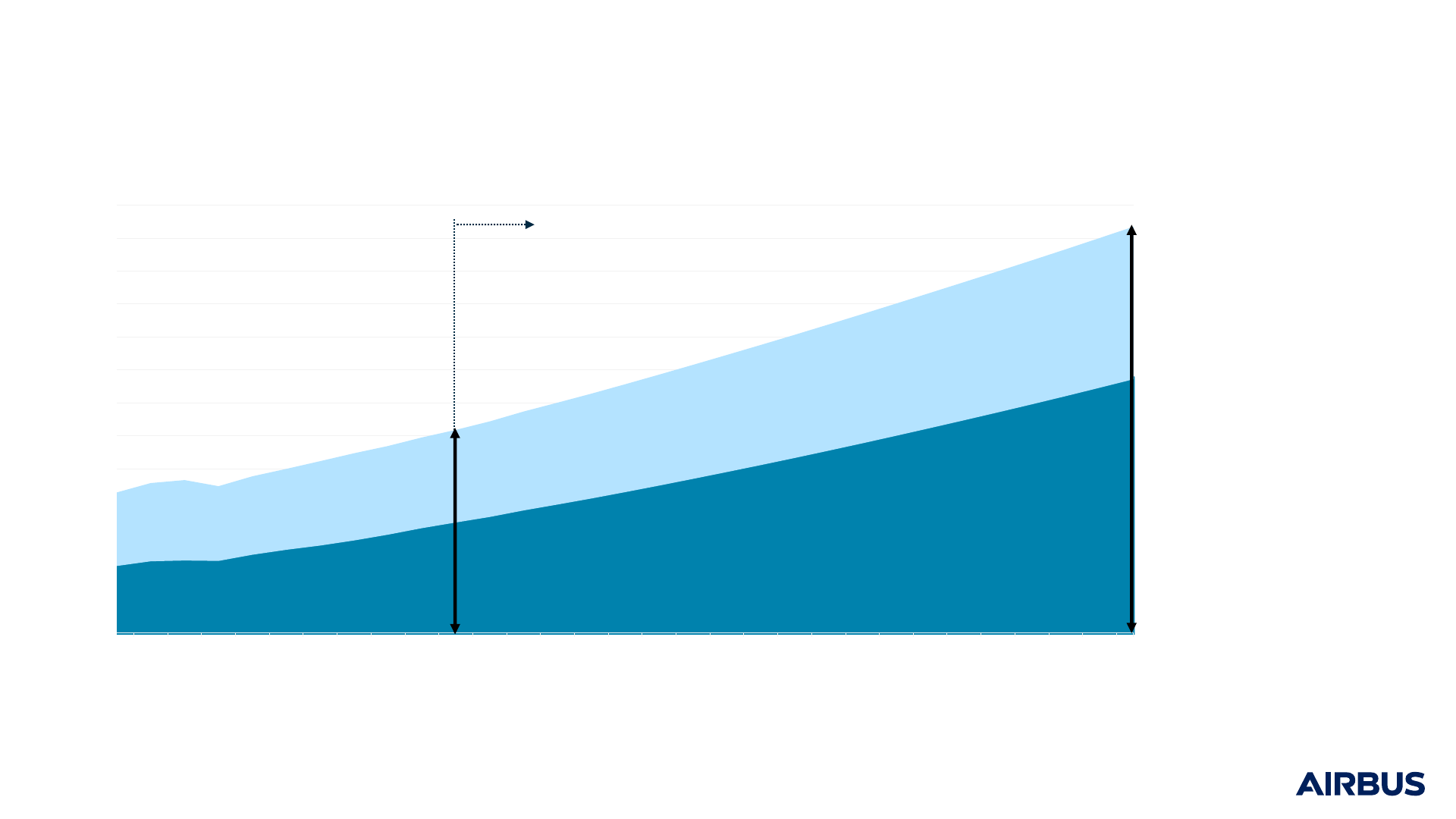

Traffic doubles every 15 years

RPK = Revenue Passenger Kilometre

Source: ICAO, Airbus GMF 2017

16

World annual traffic (trillion RPKs)

0

2

4

6

8

10

12

14

16

18

1976 1981 1986 1991 1996 2001 2006 2011 2016 2021 2026 2031 2036

x2

x2

x2

Airbus GMF 2017: 4.4% growth p.a.

ICAO total traffic

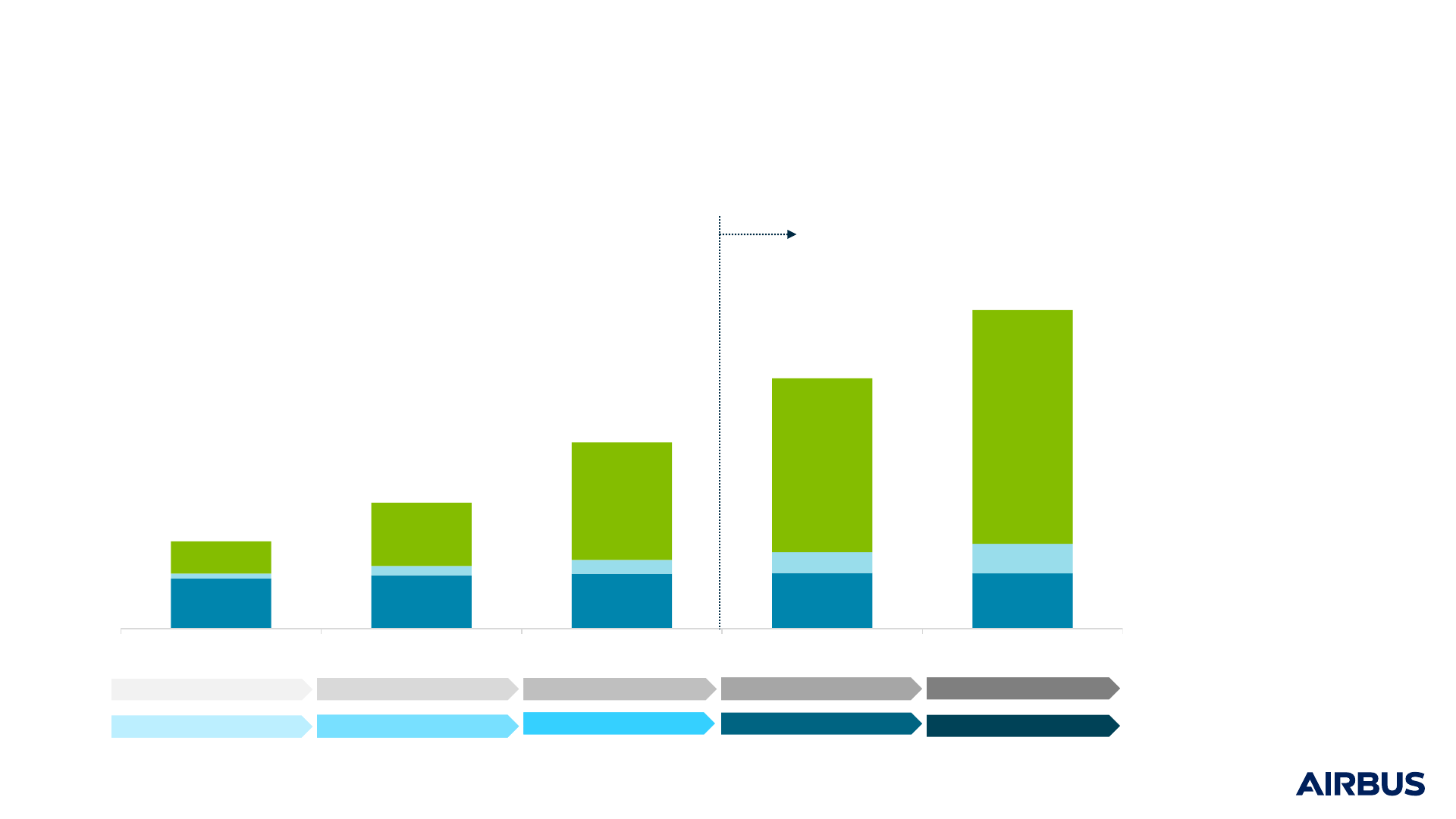

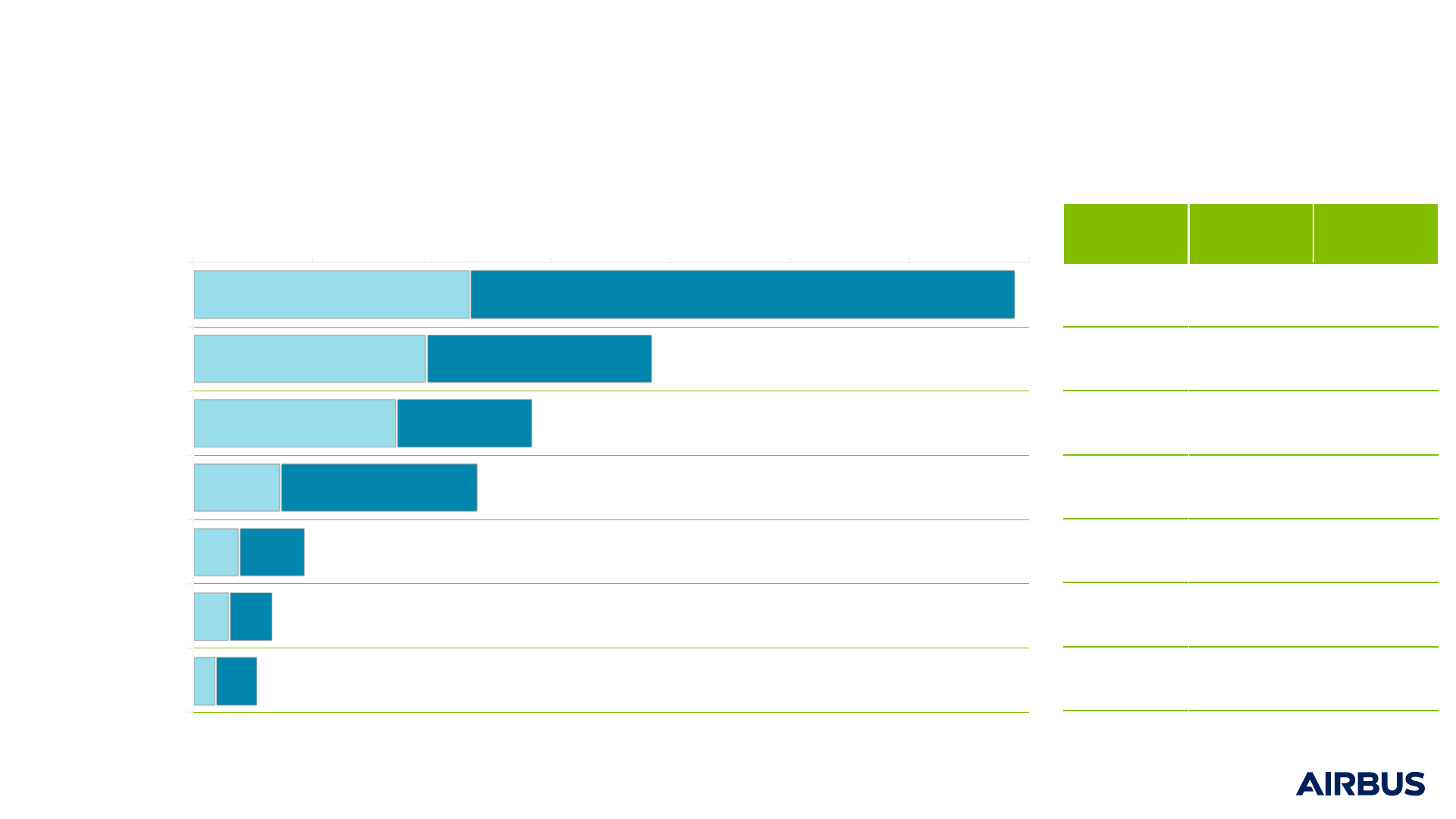

Asia-Pacific continues to grow in importance

Source: Airbus GMF 2017

17

Traffic by airline domicile (trillion RPKs)

0 1 2 3 4 5 6 7

Asia-Pacific

Europe

North America

Middle East

Latin America

CIS

Africa

20-year

CAGR

Share of

2036 RPKs

5.6% 38%

3.4% 21%

2.6% 16%

6.1% 13%

4.5% 5%

4.0% 4%

5.3% 3%

2016 traffic 2017-2036 traffic

Share of

2016 RPKs

30%

26%

22%

10%

5%

4%

3%

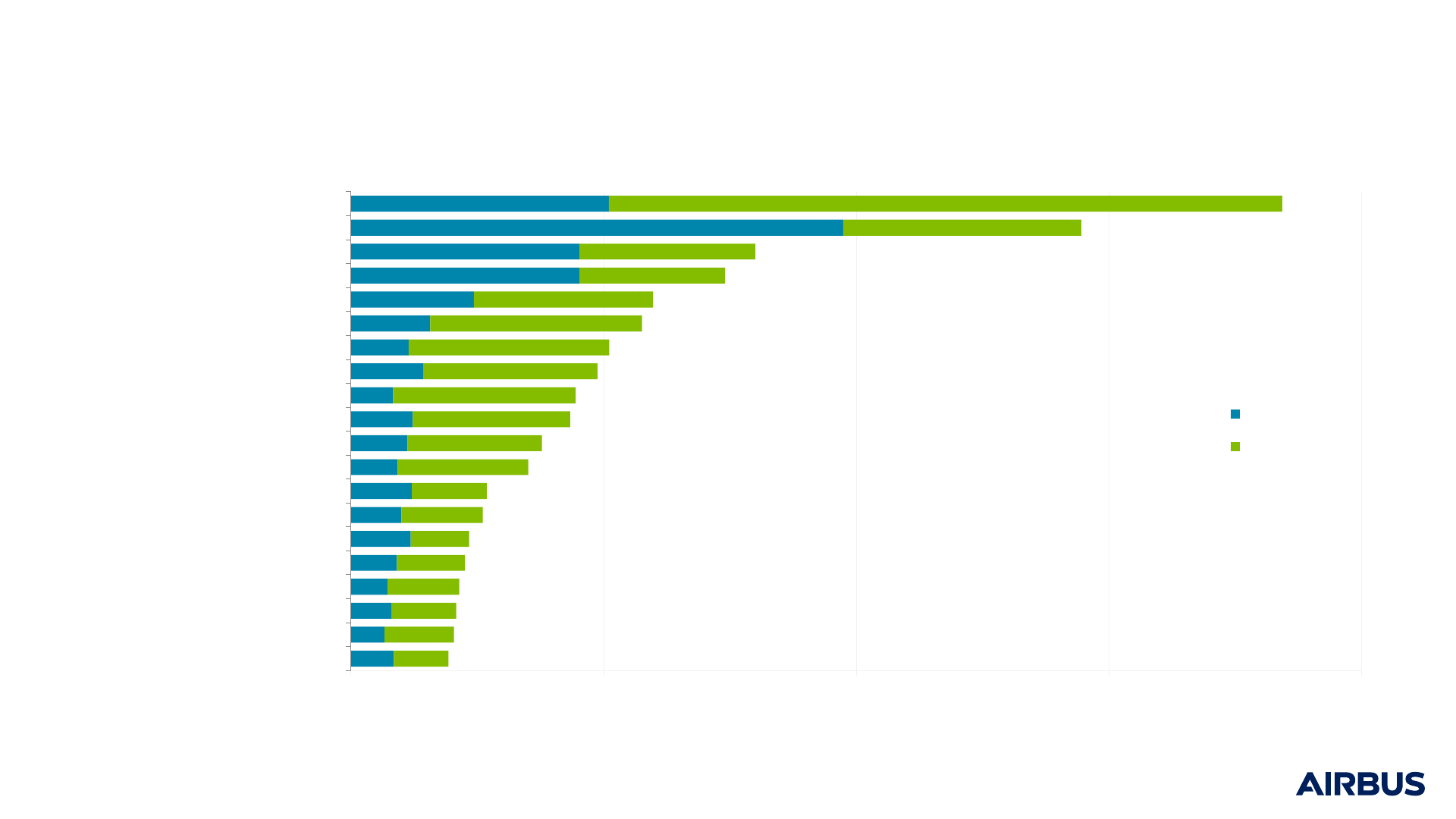

Domestic Chinese traffic to become number one

RPK = Revenue Passenger Kilometre

Source: ICAO, Airbus GMF 2017

18

Annual traffic per leg flow

0.0 0.5 1.0 1.5 2.0

South America - USA

Intra-Middle East

Domestic Brazil

Asia Developped - PRC

Asia Developped - Asia Emerging

Western Europe - South America

Central Europe - Western Europe

Western Europe - PRC

Asia Emerging - PRC

Asia Emerging - Middle East

PRC - USA

Domestic India

Indian Subcontinent - Middle East

Middle East - USA

Domestic Asia Emerging

Western Europe - Middle East

Intra-Western Europe

Western Europe - USA

Domestic USA

Domestic PRC

Trillions RPKs

2016

2036

x3.6

x1.5

x1.8

x1.6

x2.5

x3.7

x4.5

x3.4

x5.4

x3.6

x3.4

x3.8

x2.2

x2.6

x2.0

x2.5

x3.0

x2.6

x3.1

x2.3

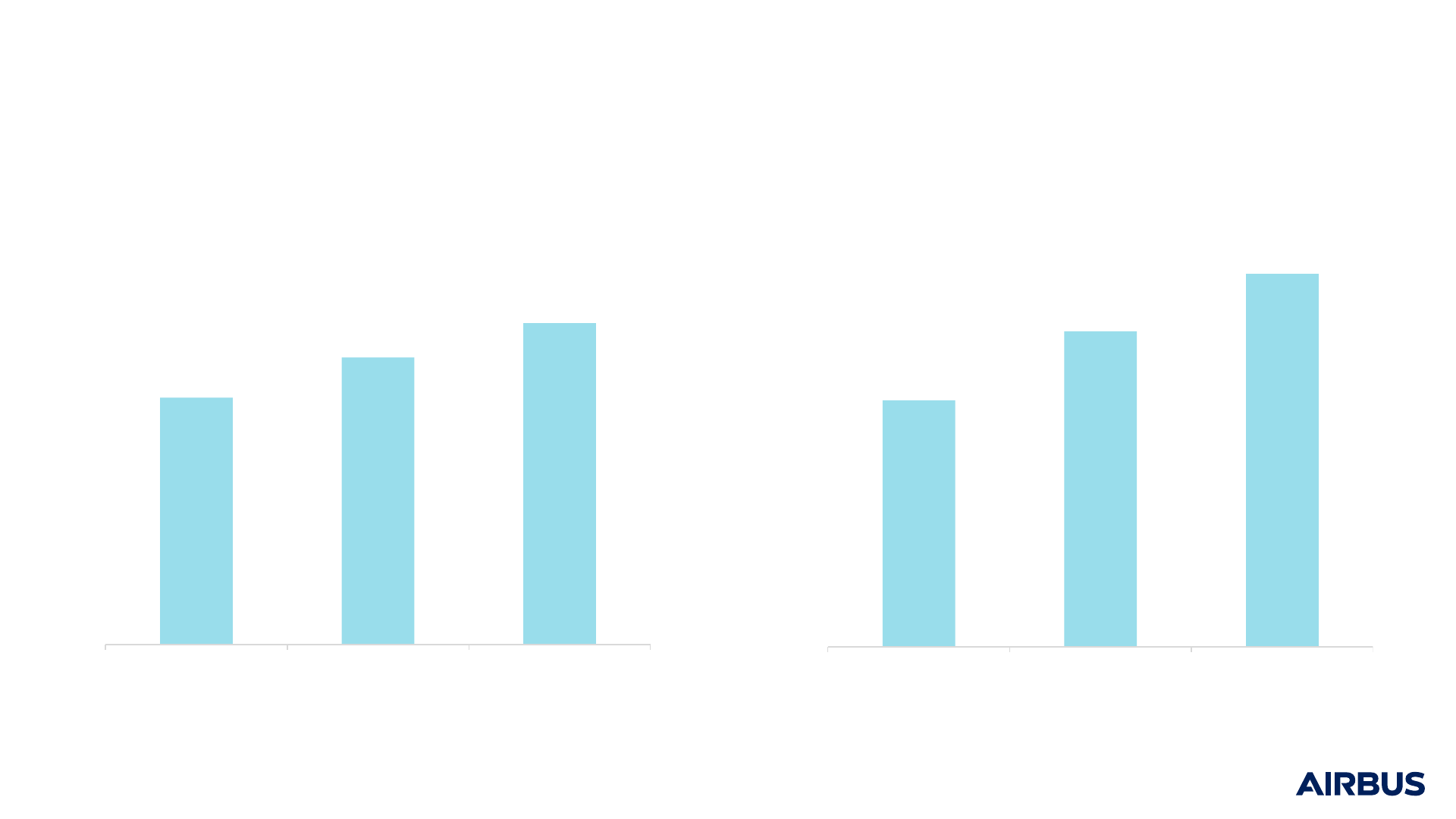

Trend towards densification, especially for Low Cost Carriers

143

150

156

100

110

120

130

140

150

160

170

2006 2011 2016

Note: Aircraft capacity above 100 seats and below 210 seats

Source: OAG – September of each year, Airbus GMF

19

All Airlines average single-aisle aircraft capacity per flight

LCCs average single-aisle aircraft capacity per flight

143

155

165

100

110

120

130

140

150

160

170

2006 2011 2016

A320 Family cabin enablers can raise A320 Family seat counts by up to 10%

20

Slim-line

seats

Space-Flex

New rear galley

configuration

Smart-Lav

New lavatory

design

New doors rating

Increased exit limit

Airbus

Cabin-Flex

A321neo new door

configuration

A319 156 160 seats A320 180 189 seats A321 220 240 seats

21

Airlines are

choosing cabin

enablers to

increase seat

count beyond 180

seats

Source: Airbus

Densification

trend

A320 deliveries above 180 seats (% total deliveries)

0%

10%

20%

30%

40%

50%

60%

2014 2015 2016 2017 2018

13%

11%

8%

8%

7%

5%

1%

74%

73%

73%

71%

62%

57%

59%

13%

16%

18%

21%

31%

37%

41%

0%

20%

40%

60%

80%

100%

2010 2011 2012 2013 2014 2015 2016

A319 A320 A321

22

The single-aisle

market continues

to move towards

higher capacity

aircraft

Upsizing

A320 Family deliveries

Source: Airbus, End December

2016, includes NEO

23

65% of net orders

41% of deliveries

of Airbus single

aisles in 2016 were

A321s

A321 –

growing in

popularity

24

Up to 240 seats &

4,000nm range

with unbeatable

fuel efficiency

A321neo

Capacity Range Fuel per seat

A321neo vs. 737 MAX

10

+10 seats +1,000nm 10% lower

25

… beats the 787

on comfort, fuel

and economics

at $20m to $25m

lower capital cost

A330neo

26

25% lower

• operating cost

• fuel burn

• CO

2

emissions

Compared to previous generation

A350 XWB

27

In 2016, 10% of all

passengers at

London Heathrow

travelled on 54 daily

A380 flights*

* Inbound and outbound

10% of all

Heathrow

passengers

28

Over 80 additional

seats with same

comfort level

as current

deliveries

* Project development study

A380

new

revenue

enablers

New rear stair

Premium Economy Class at 9-abreast

New forward stair*

Combined crew rest compartment

Economy class at 11-abreast

Upper deck sidewall stowage removal

Upper deck door 3 deactivation*

14 seats

8 seats

6 seats

20 seats

23 seats

3 seats

11 seats

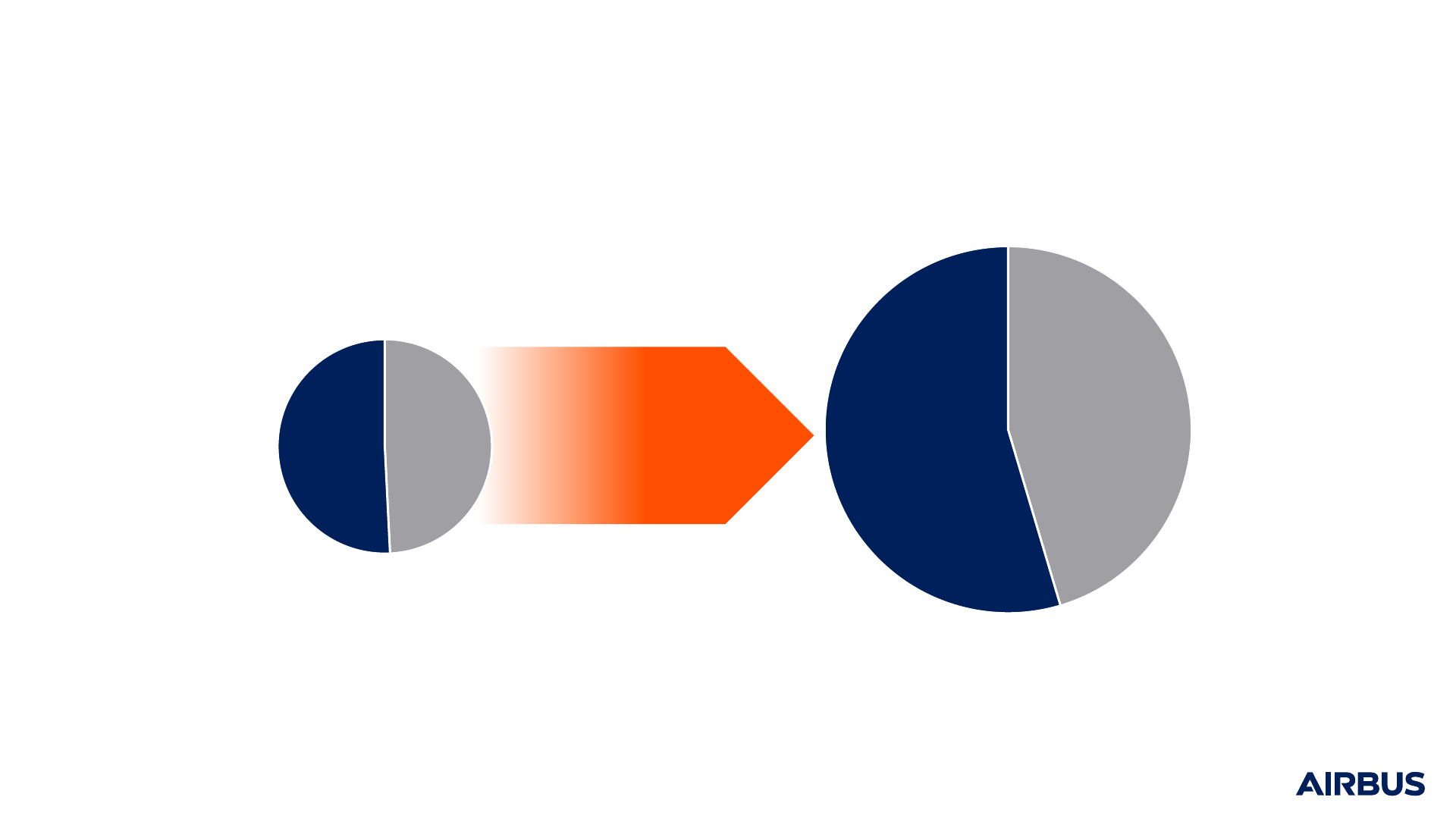

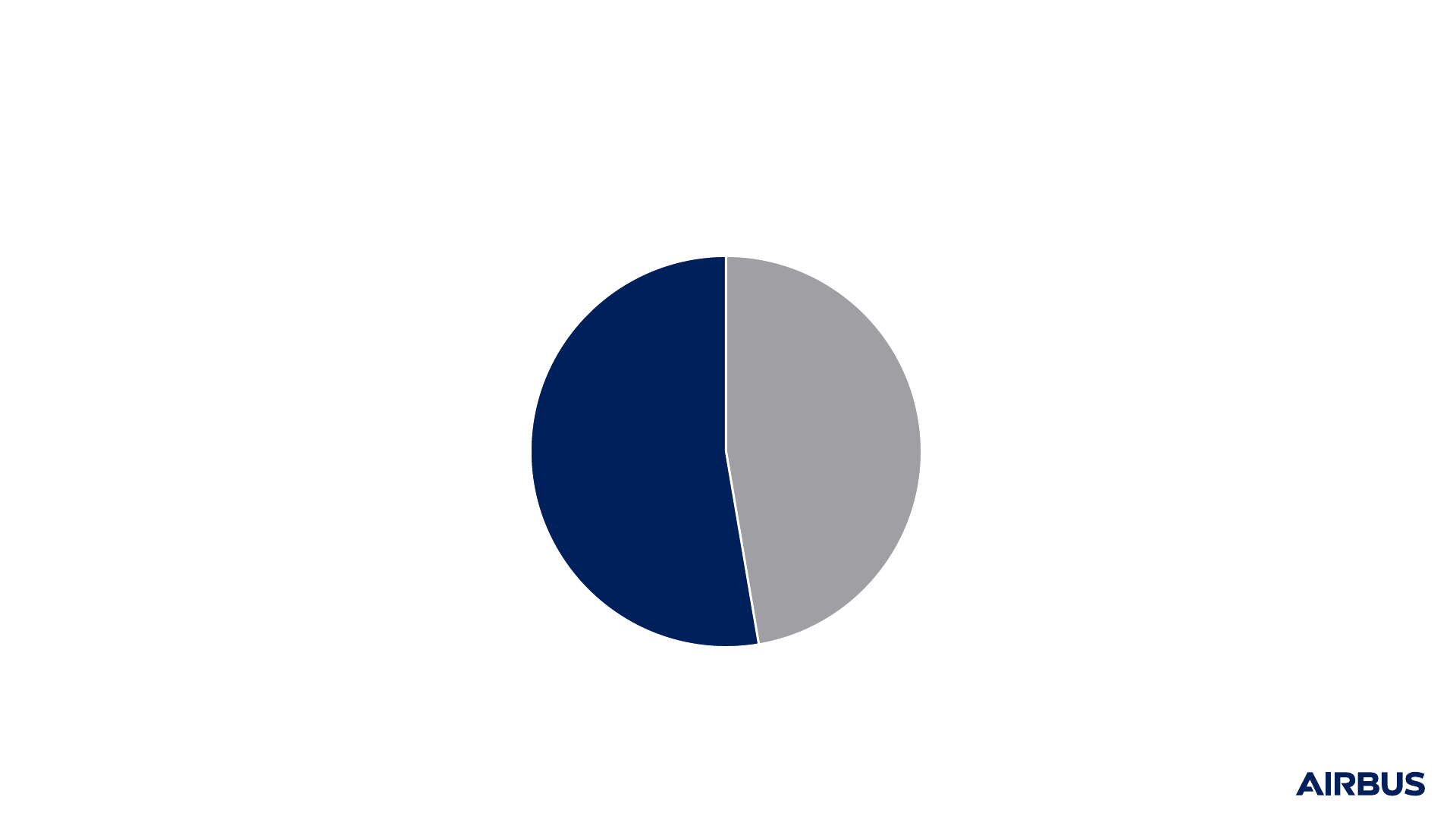

X 2.5

Backlog development 2007 - 2016

Industry backlog

12,589 aircraft

Industry backlog

4,988 aircraft

End 2016

2007

Data to end December 2016

Boeing

2,455

49%

Airbus

2,533

51%

Boeing

5,715

45%

Airbus

6,874

55%

X 2.7

X 2.3

Net market share last 10 years

Boeing

8,978

47%

Airbus

9,995

53%

Data to end December 2016

Summary

31

Drivers

Strong & resilient passenger traffic growth

As air transport develops, new drivers become more significant

Middle-class to almost double by 2036

Summary

32

Traffic forecast

Air traffic (RPK) doubles every 15 years

Airbus traffic (RPK) forecast to grow 4.4% p.a.

Fleet forecast

34,900 new deliveries by 2036:

~34,170 passenger aircraft

730 freighters

40% of new deliveries for replacement,

60% for growth

Single-aisle: 71% of units

Wide-bodies: 54% of value

Summary

33

Summary

34

Airbus Family

A321 an ideal entry-point into medium to long-haul markets

A330neo & A350XWB:

the lowest total cost widebody family with superior comfort levels

A380: The solution for future traffic growth